Trump 2.0 vs global trade: What it means for Singapore and the world

Just weeks into his second term in the White House, United States President Donald Trump has introduced a slew of trade policies aimed at exerting political pressure on other countries. What do these moves towards protectionism mean for consumers and businesses, including those in Singapore?

United States President Donald Trump’s protectionist trade policies spell uncertainty for businesses engaged in global trade and supply chains. (Illustration: CNA/Samuel Woo)

This audio is generated by an AI tool.

Staying true to his campaign promises, United States President Donald Trump has spent his first few weeks in office firing an opening salvo in a potential trade war, which has sparked market jitters and caused a stir in world capitals.

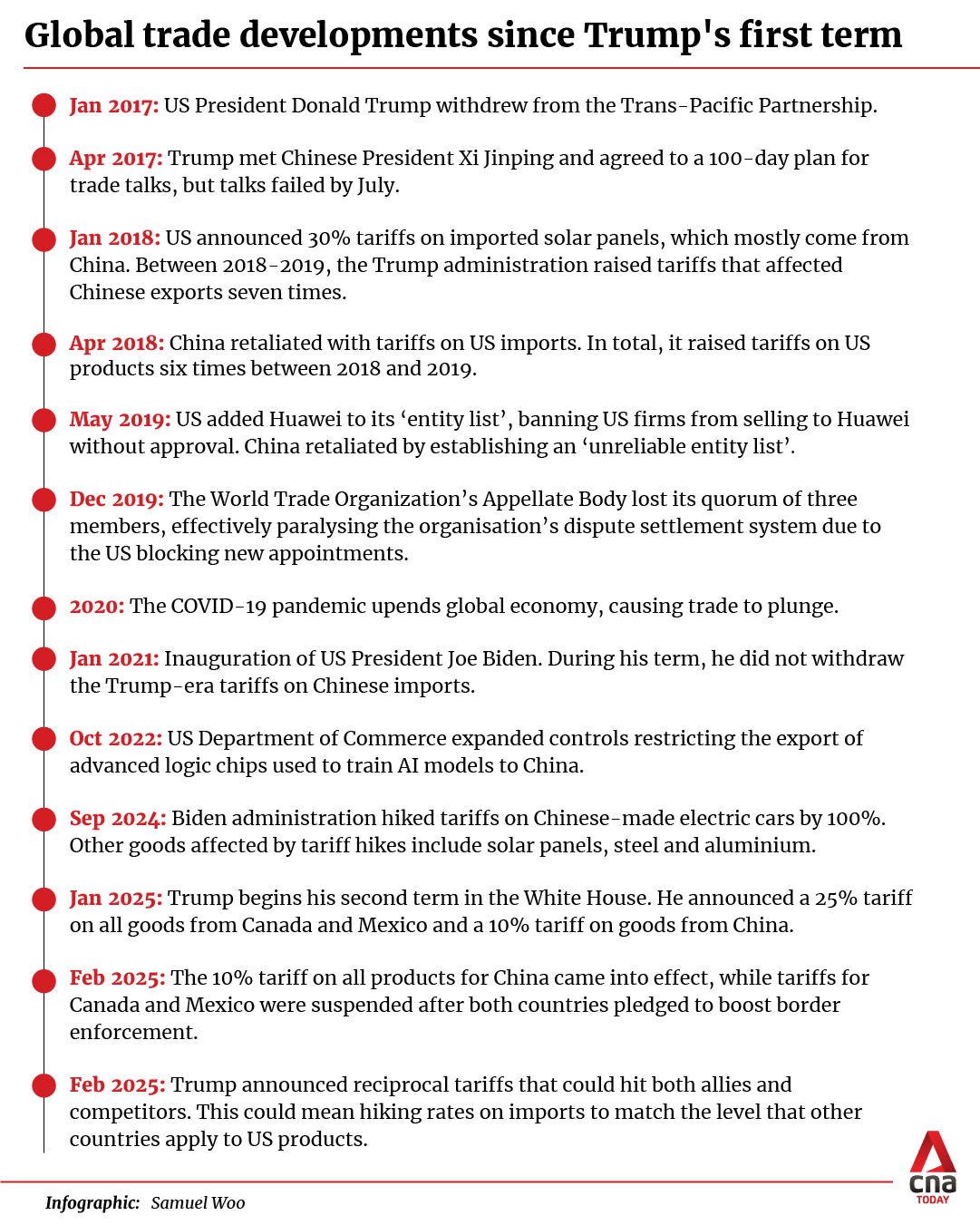

Within the first month of his return to the White House in January, Mr Trump announced a 25 percent tariff on Canadian and Mexican imports and a 10 percent tariff on Chinese goods, which he framed as necessary to force these countries to assist the US in tackling domestic issues such as illegal immigration and its opioid addiction crisis.

Most recently on Thursday (Feb 13), Mr Trump announced plans to introduce sweeping "reciprocal tariffs" on both allies and competitors. Officials said the levies will be imposed country by country, but this could mean raising rates on imports to match the level that other countries apply to US products.

Ms Selena Ling, chief economist at OCBC, said the recent announcement suggests a shift away from previous measures, which targeted specific countries or products.

This could deal another blow to the multilateral trade framework, which under the aegis of the World Trade Organisation (WTO) had been previously pushing for mutual tariff reduction, she said.

Mr Trump's latest move could risk further retaliation by major trading countries, potentially disrupting global supply chains, driving up costs for businesses everywhere and creating heightened uncertainty for the global economy, she added.

Singapore, a small, open economy where trade constitutes more than 300 percent of its GDP, is certainly not immune to the ramifications of these ongoing developments.

But businesses engaged in global trade know that these recent developments are merely the latest chapter in a neverending story of protectionism and economic fragmentation that traces back to Mr Trump’s first presidency from 2017 to 2021.

Mr T K Khor is among those whose business is directly impacted by shifts in international trade policy, as his company sources materials from China for American firms.

“When we first started in 2002, there were no tariffs and we were paying around 2.9 per cent import tax. But when Trump first came into office (in 2017), everybody was like, ‘What’s going to happen?” said the director of Singapore-based manufacturers’ representative firm Outsource Asia Industries.

From 2018 to 2019, tariffs on Chinese imports surged as high as 30 percent, a development Mr Khor initially feared would mean the “end of the world” for his business.

“Everybody was worried that we might be out of a job and that our customers might start looking for an alternative source. But they did not,” said Mr Khor.

His company adapted by absorbing some of the price increases, he said, adding that his clients have since become used to the higher prices under the new “status quo”.

Although his first presidency is often associated with trade restrictions – Mr Trump repeatedly said "tariff" was “the most beautiful word in the dictionary” — his successor, Mr Joe Biden, did not roll back the Trump-era tariffs.

Instead, Mr Biden maintained them while expanding restrictions on key industries such as semiconductors and artificial intelligence.

At Nam Shiang & Co, a Singaporean household products importer, sales and marketing manager Choo Tze Ann said a few of the factories the company worked with in China had to close during Mr Trump’s first term because of their heavy reliance on exports to the US.

Nam Shiang’s operation costs and overheads increased as raw materials, energy, production and freight costs also soared — a trend that persisted even after Mr Trump’s first term ended, due to a series of disruptions such as the COVID-19 pandemic and Russia-Ukraine war, said Mr Choo.

Though it's still early days, businesses told CNA TODAY they are bracing for greater market uncertainty, as Mr Trump’s return could spark further trade disruptions.

Experts agreed that businesses — particularly in small, open economies like Singapore — must prepare to adapt, as erstwhile champions of globalisation, such as the US, increasingly prioritise national security, domestic industries and political agendas over free trade.

But how did anti-globalisation rhetoric gain such traction in the same world that had embraced — and benefited from — globalisation, warts and all, for many decades after World War II?

And what will the consequences be, especially for businesses in Singapore, should a broader trade war erupt and tensions between the world’s two largest economies, US and China, escalate?

GOODBYE GLOBALISATION?

To be fair, the backlash against globalisation did not start with Mr Trump’s political ascendancy and his trade policies. Momentum against the process that promotes interdependence and integration of world economies had already been building over the past decade.

In the past few years, the growing focus on protecting domestic industries, not just in the US, has been reinforced by a series of global disruptions, including escalating US-China tensions, the COVID-19 pandemic, and geopolitical conflicts.

Globalisation has its roots in the multilateral trading system which took off more than 70 years ago with the establishment of the General Agreement on Tariffs and Trade (GATT) following World War II.

GATT, signed in 1947 by 23 countries, was a legal agreement meant to minimise barriers to international trade.

In 1995, the WTO was created, introducing new procedures for the settlement of disputes. As of 2024, the WTO has 166 members.

Despite decades of efforts to strengthen multilateral cooperation, analysts said that fears surrounding globalisation — as demonstrated by growing protectionism, anti-immigration sentiments, the rise of populist parties and protests against international institutions — have intensified and are likely to persist for the foreseeable future.

Associate Professor of Economics Chang Pao-Li from the Singapore Management University (SMU) said the world economy tends to repeat its cycle every century.

“The current wave of anti-globalisation and political conflicts is akin to those in the 1920s to 1930’s, which was followed by a period of trade liberalisation in the 1950s to 2000’s, coordinated by the GATT and WTO,” she said.

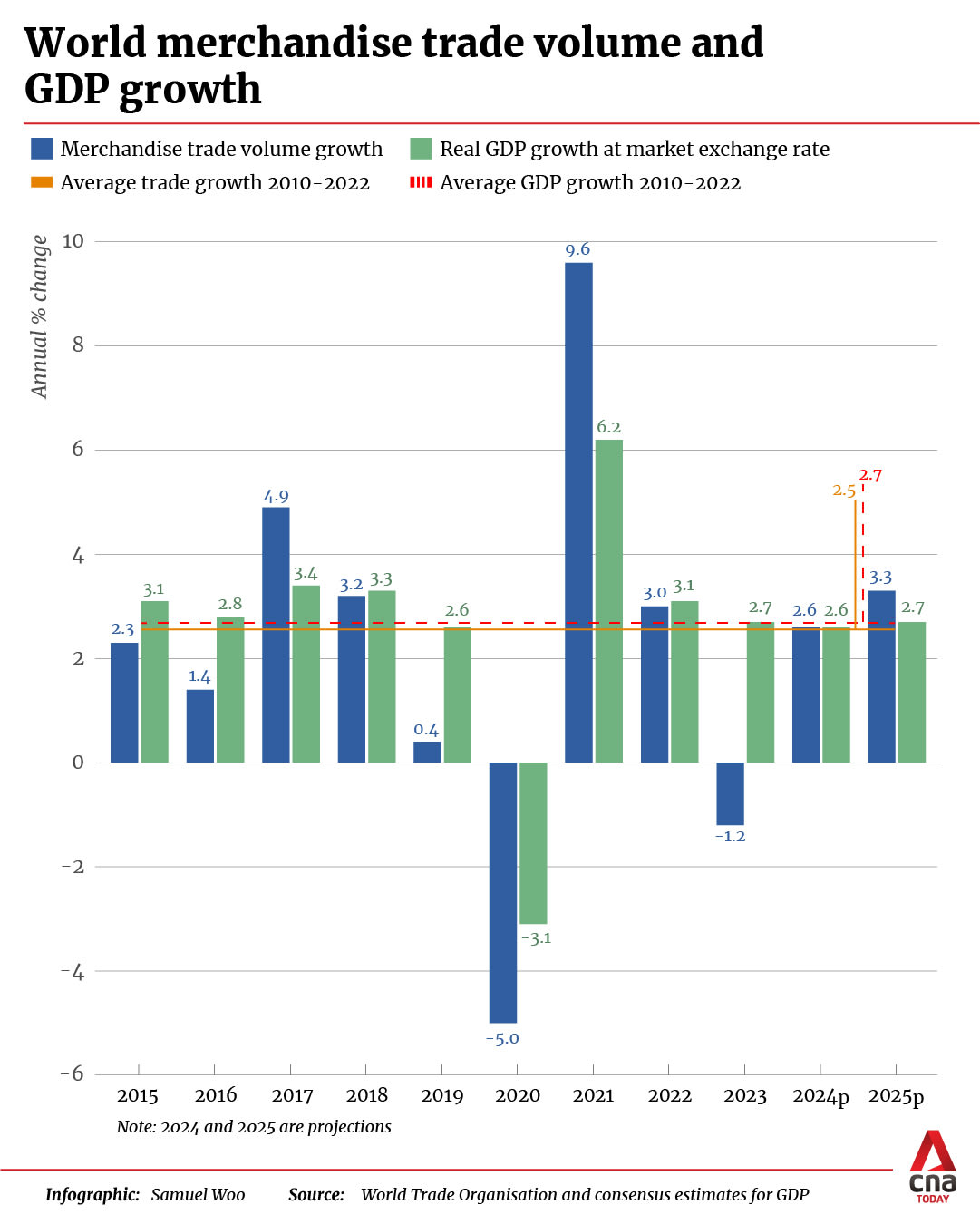

Assoc Prof Chang added that world trade growth was more volatile from 2017 to 2024, with strong growth in 2017 to 2018 before a slowdown in 2019, precipitated by the US-China trade war.

In a series of unprecedented moves not seen since the 1930s, the first Trump administration imposed seven rounds of tariff increases that affected Chinese exports between 2018 and 2019, affecting around USD$325.1 billion across over 6,000 products, said Assoc Prof Chang, referencing a 2024 paper of hers.

In return, China raised tariffs on US products, with four rounds in 2018 and two in 2019, affecting an estimated $109.3 billion of Chinese imports across over 5,000 distinct products, by 2017 trade values.

Despite a contraction of world trade in 2020 at the height of the COVID–19 pandemic, there was a strong global economic recovery in 2021 to 2022, before a slowdown again in 2023, Assoc Prof Chang added.

While Mr Trump’s approach to trade policy has promoted protectionist sentiments, experts noted that a confluence of factors has contributed to the phenomenon.

Mr Gavin Proudley, head of third party risk proposition at Dow Jones Risk & Compliance, said that global shocks in the past five years have pushed companies towards reshoring, or reducing their dependence on suppliers from far away.

“Soon after COVID was Russia’s invasion of Ukraine, and sanctions were placed on companies (with ties to Russia) to a greater extent than ever before. The impact of those events in February 2022 were profound in terms of cutting off an entire market for many organisations,” said Mr Proudley.

He also pointed to the 2021 incident in which a 400m cargo ship was stuck in Egypt’s Suez Canal for six days, causing major disruption to global shipping.

“This story of the ship just showed the vulnerability of global trade to events. Supply chains are vulnerable to sanctions, export controls and other laws, so organisations are moving towards strengthening and bringing in their value chains,” he added.

While Mr Trump’s current efforts to protect US interests may not come as a surprise to anyone, the pace at which he is implementing his trade policies could pose a challenge for companies to keep up with, said Mr Proudley.

Moreover, businesses and experts agreed that anti-globalisation trends are likely to stay here for some time.

Mr Lennon Tan, president of the Singapore Manufacturing Federation (SMF) said that steel and aluminium tariffs imposed in Mr Trump’s first term had a deep impact on Singapore’s manufacturers.

“Many of our members faced increased costs for key components, disruptions to established supply routes, and a general sense of uncertainty regarding future market access,” said Mr Tan.

While some of these tariffs have been adjusted since, their legacy endures. For example, US restrictions on semiconductor-related equipment and technology transfers, which began during the first Trump administration, continue to influence SMF members' cost and sourcing strategies for semiconductor and precision engineering industries, Mr Tan said.

THE POLITICISATION OF TRADE POLICY

Despite the well-documented dangers of protectionism, including higher prices for consumers and tit-for-tat tariffs that could escalate into trade wars, protectionist trade policies are likely to persist because some countries are using their export control laws and sanctions as instruments of foreign and security policy, analysts told CNA TODAY.

In the US case, a favoured tool in President Trump’s arsenal is the imposition of tariffs, which have long been used to protect domestic industries.

“Protectionism is essentially safeguarding self-interest and your local industries from foreign competition. In simple terms, you impose import barriers, one type of which is tariffs,” said Professor Lawrence Loh from the National University of Singapore (NUS) Business School.

A tariff is a tax imposed by one country on imported goods to reduce local demand for foreign products by artificially increasing their price, addressing trade imbalances.

However, in recent years, tariffs – or the threat of tariffs – have been used to exert political pressure on other countries.

Prof Loh, who is director of the Centre for Governance and Sustainability, noted: “Trump is using these tariffs as a punishment tool. There’s no relation between tariffs and illegal immigration, but he’s using it so (neighbouring countries) will be more vigilant in their border control and in the export of drugs.”

The most recent announcement of "reciprocal tariffs" signals a more dynamic approach towards tariffs, with Mr Trump wielding the cudgel at both friends and foes, Prof Loh added.

"Precisely because of that, it is a more effective tool to extract concessions. The way he looks at tariffs is not just to protect domestic industries, it's much more than that. It's a diplomatic tool to induce, or even coerce, certain behaviour."

Mr Steve Wilford, a partner at global risk consultancy Control Risks, added that a central focus of trade policy under Mr Trump’s first administration was “exacting fairness”.

This encompassed efforts to curb perceived Chinese dumping, combat the theft of strategic intellectual property and redesigning or withdrawing from regional agreements viewed as detrimental to US interests.

Although these efforts, which he noted the Biden administration continued “to quite a high degree”, led to worsened US-China relations, they also signalled to American allies that US trade policy, wielded as a tool of geopolitics, had taken a “self-interested turn”, said Mr Wilford.

Among the latest signs that Mr Trump is indeed using tariffs as a bargaining chip, his administration put on hold sanctions and tariffs against Colombia in January 2025 after its government agreed to all of the US President’s terms, including the unrestricted acceptance of US military flights carrying Colombian deportees.

Following that, after Canadian and Mexican authorities pledged to boost border enforcement, President Trump paused the 25 per cent tariffs on both countries for 30 days.

In the case of China, the 10 per cent tariff on Chinese imports, which took effect this month, was justified by Mr Trump as a call for Beijing to better staunch the flow of fentanyl, a deadly opioid, into the United States.

China’s foreign ministry denounced the tariffs, stressing that “fentanyl is America's problem”. China has retaliated with fresh tariffs for certain American goods, including a 15 per cent import duty on liquefied natural gas and coal.

On Feb 6, the Chinese government filed a formal complaint against Washington at the WTO, stating that the US measures appeared to be inconsistent with obligations under the trade body.

However, experts noted that the WTO’s power to resolve disputes has been effectively paralysed in recent years due to the US blocking the appointments and reappointments of the WTO’s Appellate Body panel members.

Both Mr Trump and Mr Biden opposed the appointment of new judges to the body over its alleged judicial overreach in trade disputes.

The body cannot function with fewer than three judges. This means that, for dispute settlement cases in which a country appeals against a ruling, the dispute cannot be resolved.

Assoc Prof Chang from SMU said that the current WTO settlement procedure is thus “crippled”.

“Although members raised complaints against Trump's tariffs under the dispute settlement procedure of WTO, as China did a couple of days ago, the dispute won’t reach its official resolution,” she said.

President Trump has shown little fondness for the WTO, as evidenced by his repeated threats to pull out of the organisation during his first term, frequently criticising the WTO for being ineffective and unfair to the United States.

TIME FOR CHINA TO PLAY A BIGGER ROLE?

As the influence of global institutions such as the WTO wanes, and with the Trump administration showing disdain for the multilateral trading system, would it be a natural move for China to step in as the new leader of global trade?

After all, despite facing tariffs, sanctions, and export restrictions, China has continued to expand its trade influence worldwide and deepened trade relationships with other economies, analysts noted.

In a notable move, China joined the 15-nation Regional Comprehensive Economic Partnership (RCEP), a free trade agreement including Indonesia, Singapore, and New Zealand that came into effect for 10 participating countries in 2022.

Prof Loh from NUS said: “With the pull-back by the US, it’s only natural for China, as the next biggest economy, to step in to fill the void of global trade leadership. In fact, with all the protectionism, the US will lose the moral authority to shape world trade or even the global economy.”

Countries may become wary of US trade moves which can “flip-flop within days” and worry if they are next in line for trade restrictions, he added.

Rather than crippling Chinese industries, US sanctions and trade restrictions have also forced China to develop its own advanced technologies, reduce reliance on Western suppliers, and accelerate domestic innovation.

Prof Loh cited the example of Huawei, the Chinese company blacklisted by the US Commerce Department in 2019 and placed on the “Entity List”, which requires the company to obtain US government approval to buy American technology.

In response, Huawei developed its own operating system and chips. More recently, DeepSeek, a Chinese AI company has sounded the alarm about the future of American dominance in artificial intelligence, emerging as a cost-effective AI solution that competes with OpenAI’s ChatGPT.

Analysts also noted that the role of China-based companies within the value chains of many of the world's largest companies cannot be underestimated.

Ms Tam Nguyen, the chief executive officer (CEO) of GOL Solutions, observed that some of her clients, in an effort to avoid US tariffs on China during Mr Trump's first term, adopted a strategy known as 'China Plus One (+1)’, diversifying their supply chains to other Asian nations.

Her firm, a Singapore-based supply chains solutions provider, supports e-commerce businesses, manufacturers, and logistics companies in complying with trade regulations and maintaining uninterrupted supply chains.

However, countries in Southeast Asia face “significant hurdles” in offering themselves as alternatives to China, as most of the region lacks well-established supply chain networks, from sourcing raw materials to production and final assembly, she said.

“Achieving complete independence from China is not feasible. The ‘China +1’ strategy, therefore, focuses on establishing alternative assembly plants outside China while continuing to rely on China for raw materials,” said Ms Nguyen.

While companies may rethink their reliance on China-based suppliers, a whole-scale restructuring of a supply chain, if chosen as a strategy, would take many years, added Mr Proudley from Dow Jones.

He noted that businesses are closely monitoring both Chinese and US policies, though some may feel increasing pressure to choose between expanding in the US and China.

“In both markets the regulatory framework is in a state of flux and keeping up with changes is challenging. Being able to do business compliantly across the globe is getting harder and requires careful navigation of complex requirements,” Mr Proudley said.

TROUBLE FOR S'PORE BUT OPPORTUNITIES TOO

Although trade policy often focuses on high-level concerns between nations, its implications deeply affect the everyday consumer.

As uncertainty about trade policies such as US tariffs grows, global trade and growth may slow. This will have ripple effects on small and trade-dependent countries like Singapore, which will suffer from weaker global demand.

“In any trade war, economic efficiency suffers and economic growth suffers, because you’re not operating at your optimal level and are upsetting the principle of comparative advantage,” said Prof Loh.

He said that US tariffs on Chinese goods may increase costs for US’ own industries that are reliant on Chinese imports, making their production more expensive.

A decline in US industries could thus limit their business expansion and cause such firms to be less able to import from and invest in Singapore.

While there may be a “displacement effect” where other Asian nations stand to gain from China’s losses, Prof Loh said Singapore is likely to be worse off in a trade war, due to reduced US investment activity and impact on economic growth.

“If investments decline, job opportunities will decline. We are importing a lot of consumer goods and industrial goods from the US, and costs will increase and our businesses will suffer as their profits will be lower,” said Prof Loh.

These effects, however, will not come as a complete shock, as many of the current measures – including the restoration of a 25 per cent tariff on steel and aluminum imports – are familiar elements from Mr Trump’s first presidency.

“The spots on the leopard skin are the same. If you look at trade war one, you can learn a lot about what will happen in trade war two,” said Prof Loh.

But technology may play a greater role and face greater scrutiny this time round.

Southeast Asia Lead Analyst at Control Risks Harrison Cheng pointed to recent claims that DeepSeek might have sourced advanced Nvidia chips through intermediaries in Singapore.

“(This) will only deepen US concerns about Singapore’s capabilities to crack down on companies trying to circumvent US export controls targeting Chinese technology,” said Mr Cheng.

Though the Singapore government has said that it expects US companies like Nvidia to comply with domestic legislation, it remains to be seen if these developments will lead to strict licensing requirements on the import of advanced AI chips, he added.

Despite predictions that Singapore could face slower growth and weaker business sentiment in the face of new US tariffs, some other businesses are looking out for potential opportunities on the horizon.

With greater restrictions on Chinese products and brands, Ms Nguyen from GOL Solutions said Singaporean products could see greater demand in US markets.

She has recently seen a surge in Singaporean businesses looking to be licensed with the United States Food and Administration that regulates foods, cosmetics, medical devices and drugs for the US market.

While Mr Melvin Tan, CEO of engineering solutions firm Cyclect, has concerns about shrinking US economic output, he also sees potential areas for growth.

For example, global companies might relocate their operations to open economies like Singapore, allowing Mr Tan’s company to help these firms establish and grow their operations.

This has also been facilitated by efforts to step up regional collaboration such as the Johor-Singapore Special Economic Zone (SEZ), Mr Tan added, helping his firm maintain cost-effectiveness through local sourcing networks.

The agreement on the SEZ, inked in January, stated that the deal will promote and facilitate investments across 11 sectors including manufacturing, logistics, food security and energy.

“While global trade tensions create market uncertainties, our position gives us unique advantages – companies are increasingly seeking stable regional partners who understand both local and international compliance requirements,” Mr Tan noted.

SINGAPORE'S RESPONSE

The United States is unlikely to impose direct tariffs on goods from Singapore, but the city-state will still feel indirect impacts from tariffs, Singapore’s Foreign Affairs Minister Vivian Balakrishnan told Parliament on Feb 4.

However, he emphasised that Singapore and the US enjoy a very long-standing partnership which has been nurtured over 60 years, spanning both Democratic and Republican administrations.

“Today, the US is our top trading partner in services, our second largest in goods and our largest foreign investor. In fact, if you add up the stock of US foreign direct investment into Singapore, the US has invested more in Singapore than it has invested cumulatively in China, India, Japan, and the Republic of Korea combined,” said Dr Balakrishnan.

However, he added that the world is at a new inflection point, where the liberal world order has lost domestic political support in many parts of the world.

The global economy is now decoupling as a result of the “significant lack of strategic trust” between the US and China, and Singapore’s strategy has been to engage with multiple poles of emerging powers including the US, China, India, the European Union, Africa and South America, he noted.

“We need to keep calm, keep our eyes open, be very careful in what we say and how we behave. Playing it straight, saying the same thing to everyone, and meaning and doing what we say, is valuable,” said Dr Balakrishnan.

Experts concurred that it will be crucial for Singapore to double down on trade diversification if it becomes clear that the US cannot be persuaded from the path of protectionism.

Mr Cheng from Control Risks, a global risk consultancy, said this means continued progress on regional trade architecture such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and RCEP.

“The direction of trade policy is not going to differ, but the intensity of efforts to speed up the opening of trade with alternative markets is likely to increase. These diversification efforts have been in the works since the previous Trump presidency, which heightened fears of a fragmented trade environment,” said Mr Cheng.

Businesses, too, pointed out the opportunities to be had by strengthening regional ties and promoting domestic innovation.

Mr Kenneth Lee, CEO of semiconductor equipment solutions provider Global TechSolutions, said that he anticipates potential challenges in cost structures and market access, given the US focus on reshoring semiconductor manufacturing.

In Mr Trump’s first term, the increased US tariffs and restrictions on semiconductor-related exports and imports led to rising costs in sourcing critical components, he said.

In anticipation of further uncertainties and potential disruptions during a second Trump term, Mr Lee said government policies that enhance supply chain security, strengthening partnerships between semiconductor hubs like Malaysia and Taiwan would be beneficial.

“Additionally, initiatives that promote advanced engineering talent development and provide incentives for R&D by small and medium-sized enterprises and automation would enable SMEs like us to remain competitive against larger global players,” said Mr Lee.

Mr Tan from the SMF said a push towards regionalisation could present a unique advantage for local manufacturers with established regional networks.

This could be further supported by authorities strengthening regional trade frameworks like the RCEP and fostering closer ties with ASEAN, China and the EU, creating a more favourable and predictable trade environment that cushions against unilateral US policy shifts, said Mr Tan.

While potential supply chain disruptions, increased costs and compliance uncertainties for high-tech components remain a concern, Mr Tan said the ongoing geopolitical realignments are bound to drive innovation.

The current environment could also help the manufacturing industry by accelerating investments in digitalisation, automation and localised manufacturing capabilities.

“Through strategic diversification, proactive policy engagement and a commitment to innovation, our key sectors are well-positioned to thrive in a dynamic and sometimes uncertain global trade environment,” he said.