Living on borrowed money: More platform workers taking on longer hours, loans just to survive

In the past few years, some debt recovery agencies have been seeing a steady rise in debtors who are platform workers.

Private-hire car driver Mohammad Fadli (pictured) has had to take up loans to keep up with his family’s expenses. (Photo: CNA/Nuria Ling)

This audio is generated by an AI tool.

Private-hire car driver Mohammad Fadli typically knocks off work at around 4am after a six-hour shift.

By 7am, the 43-year-old is back on the road for another six hours, fetching people to their workplaces all across Singapore until the early afternoon.

The morning peak-hour crowds yield the most gains for Mr Fadli, so he never misses them. However, such 12-hour work days were not always the norm.

Driving for about 10 hours a day would have been enough for him to comfortably provide for his family just three years ago.

Now, even with his extended hours, he does not always earn enough to keep up with his family's expenses.

As a result, he had to take up three loans over the past two years to pay the loan instalments for his car, as well as for his family bills and day-to-day expenses.

“I have four kids and they are all still living with me,” he said.

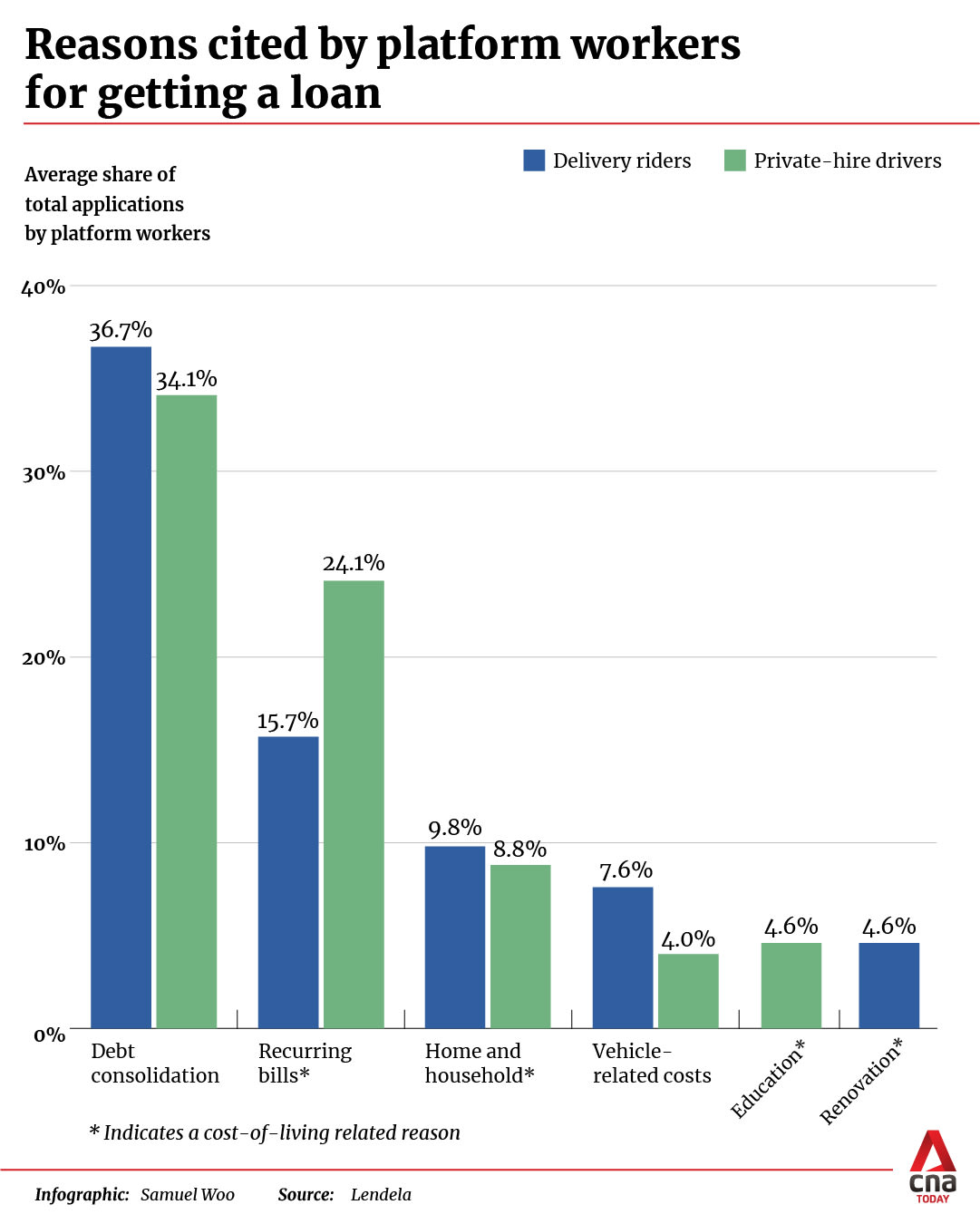

For eight quarters since January 2023, the proportion of platform workers – private-hire drivers and delivery riders – who applied for personal loans due to cost-of-living pressures had risen by 12 per cent.

This was from a report published last Monday (Mar 10) by Lendela, a financial technology site that matches borrowers with personalised loan options from various financial institutions.

Lendela did not provide absolute figures, saying that it was because of commercial sensitivities.

Its Singapore country manager Bryan Tay said that its data was based on a sample of about 15,000 platform workers' applications to its site from the first quarter of 2023 to the fourth quarter of 2024.

The report also found that debt consolidation was the most common purpose for private-hire drivers (36.7 per cent) and delivery riders (34.1 per cent) in Singapore to apply for a loan.

For Mr Fadli, his loans came from ride-hailing firm Grab's financing programme. Launched in 2023, the Partner Cash Advance programme provides loans of up to S$10,000 for private-hire drivers and delivery riders under Grab's platform.

The programme is open to active driver and delivery-partners who have driven with Grab for at least three months, have average monthly earnings of at least S$1,000 and have met Grab’s internal credit risk assessments.

Mr Fadli has taken three loans under the programme, ranging from S$3,000 to S$6,000, on separate occasions. He has since paid them off, he said.

His situation is far from rare, based on conversations that CNA TODAY had with nine platform workers.

Mr Chris Tan, a 54-year-old private-hire driver, said that he knows “many” gig workers who have taken loans – either from Grab or other legal moneylenders – to help sustain their living expenses.

“I cannot take out loans because I have a bad credit score. But if I could, I would,” he admitted.

Credit Counselling Singapore – a non-profit that helps debt-distressed people through counselling, education and facilitating repayment arrangements – told CNA TODAY that it has seen fluctuations in the number of platform workers approaching it for help in recent years.

In 2022, it served 128 of these workers. This went down to 102 in 2023, before rising to 143 last year.

The most common reason given by these workers for getting into debt was a drop in their total household income.

The struggle to cover recurring bills was common among the workers, who are increasingly viewing loans as a necessity to tide through financially tough periods.

Mr Tan the private-hire driver is a single-parent with two children who are still studying in a secondary school and polytechnic.

He noted that fuel prices have almost doubled from a decade ago and the price of car rentals and daily necessities have increased, while his monthly income has not made equal gains despite him putting more hours on the road.

“Everything is rising, but the money I make is dropping.”

LOANS INCREASINGLY NECESSARY

In response to CNA TODAY's queries on the demand and take-up rate of Grab's Partner Cash Advance programme, the company did not provide data, but stated that it was part of broader partner welfare efforts to help its partners have better access to credit for managing cash-flow needs.

Grab is the only ride-hailing or food delivery platform in Singapore that offers a loan programme to its workers.

Last year, statistics from the Ministry of Manpower (MOM) showed that there were about 67,600 resident platform workers – 60,000 of whom considered their jobs to be their main source of income.

Of the 67,600, there were around 31,800 private-hire drivers and 15,300 delivery workers, with taxi drivers making up the remaining.

A study by Singapore bank DBS published in July 2023 found that for two consecutive years, platform workers spent more than what they earned.

They were the most financially stretched among all customer groups that the bank examined.

Notably, platform workers saw an expense-to-income ratio of 112 per cent in May 2023, significantly higher than that of a median DBS customer at 57 per cent.

With relatively less stable income flows and not enough income to cover their spending, platform workers have had to tap their savings to cover their expenditure needs.

However, generating savings is a difficult task for platform workers who have modest incomes that can fluctuate from month to month.

In 2023, their median earnings were around S$1,500 to S$2,500 a month, MOM said.

The gig workers who spoke to CNA TODAY said that the situation has not improved since then and it has gotten worse.

Delivery rider Mohamed Norfirdaus said that he once could earn an average of S$180 daily just two years ago. These days, even earning S$100 is a struggle and he has little savings should life throws him a curveball.

Mr Norfirdaus, 43, was diagnosed with colon cancer in 2023 and could not work for nine months while he underwent chemotherapy and an operation on his colon.

His wife is also unable to work because she has health issues with her spine and knees, he added.

The couple have no children, but Mr Norfirdaus did not have enough savings from his average monthly income of around S$2,000 to sustain themselves for the nine months that he was unemployed.

This led him to take two loans of about S$1,500 each from licensed moneylenders to tide them both through the period.

Such unexpected emergencies hit platform workers harder than most and can sometimes leave them stranded in debt, experts noted.

Of the four debt collection agencies contacted by CNA TODAY, three said that they have observed a steady increase in the number of clients who wish to collect debt from platform workers in the past two years.

Their most common clients are licensed moneylenders and companies that lease cars and motorcycles to platform workers and are trying to recover the money owed from these workers who have defaulted on their monthly payments.

One of these debt collection agencies, ASK Debt Recovery, said that two years ago, it would typically take on anywhere from five to 10 cases each month involving platform workers, but that frequency has risen to five to 10 cases weekly since last year.

GXS Bank, a digital bank with Grab as one of its shareholders, said in response to CNA TODAY's queries that although there has been an increase in the number of these workers taking out loans, it was aligned to a general growth in numbers from its overall customer base.

It added that the average loan size for platform workers is in the "low thousands", which is lower than the average loan size.

Mr Leroy Ratnam, the chief executive of JMS Rogers Debt Collection Services, agreed that the sum of platform workers' loans from financial institutions are indeed smaller compared with other consumer groups, often ranging from S$2,000 to S$4,000.

However, Mr Ratnam said that it is also common to see such workers owe larger sums to family and friends in the range of S$10,000 to S$20,000, because there are no limits in these instances.

The agencies also often deal with cases where platform workers have gotten into accidents and have defaulted on paying either repair fees or "excess" – the amount one has to fork out before an insurance company covers the remaining costs.

Mr Ratnam said that his firm's investigations and conversations with debtors often reveal that the main factor behind why they are unable to pay up is because of higher costs of living.

"They’re not trying to be irresponsible towards their payments, it is not because they are overspending or living luxuriously. When it comes to platform workers, they're always just trying to survive hand to mouth."

Mr Marcus Chow, a 47-year-old who worked as a private-hire driver from 2022 to 2024, believes that these are the challenges outsiders seldom see.

“I got into a couple of accidents back then. Each time, the pay I worked for the entire week is gone just like that.”

A CYCLE OF DEBT

It is common for lenders to provide loan terms that are less favourable to self-employed applicants, who are deemed “more risky” due to their variable income, economists said.

Mr Rocky Ng, a 31-year-old who has worked as a full-time delivery rider periodically for over a decade, said: “If you want to earn S$100 a day doing delivery work, we’re talking about more than 30 trips. A lot of your earnings will go into either maintenance or sustenance.”

Associate Professor Walter Theseira from the Singapore University of Social Sciences’ School of Business said that if platform workers’ loan applications are for cost-of-living expenses, they may be caught in a cycle of debt.

“If people are borrowing to pay for the ordinary costs of living, but (their) cash flow is consistent, then this will almost certainly further increase the cost-of-living challenge because debt repayments need to be made on top of these costs.”

Private-hire driver Lalitha Dorairajoo, 46, said that sole breadwinners face an overwhelming pressure to work longer hours to make more money, but this increases the risk of them getting into accidents, which only further perpetuates the debt they might have to repay.

Assoc Prof Theseira said that working longer hours to bump up earnings is less sustainable in the long run, since earnings are based largely on conditions of supply and demand.

Mr Ng who has worked as a delivery rider said that things outside of riders’ control can make a dent in their income as well.

“If it’s raining, there is no incentive for riders to work. You can’t control rain – if riders work during bad weather conditions, they’re risking their lives.”

Additionally, Mr Ng and other delivery riders noted that they often have no choice but to take jobs that appear unreasonable, because rejecting these jobs can result in them not qualifying for incentives set by the delivery firms.

Mr Ng gave an example of a friend who had to make several trips to and from a supermarket to deliver more than 10 cartons of water because he was unable to safely load all of it on his motorbike in one trip.

“We use all that time and risk our safety just for S$5,” he said.

ASSISTANCE FOR PLATFORM WORKERS

The Platform Workers Bill was enacted on Jan 1 this year and in the same month, the National Trades Union Congress (NTUC) successfully registered three new platform work associations with MOM.

They are the National Taxi Association, the National Delivery Champions Association and the National Private Hire Vehicles Association.

These associations have similar legal authority to trade unions and are able to hold online platforms accountable and organise legally binding collective agreements.

Ms Yeo Wan Ling, NTUC’s assistant secretary-general, acknowledged that many platform workers have resorted to longer driving and riding hours to make ends meet.

Ms Yeo, who is adviser to the National Delivery Champions Association and the National Private Hire Vehicles Association, added that the platform work associations provide temporary and short-term financial assistance for its members. These include:

- NTUC Care Fund (Work Injury Relief)

For platform workers who are prescribed medical or hospitalisation leave for a continuous period of five or more days, NTUC FairPrice supermarket vouchers worth S$250 will be given to eligible members to help put food on the table while they recover.

- NTUC Care Fund (Special Assistance) 2025

A sum of S$150 will be given to eligible lower-income NTUC union members to assist them in coping with the rising costs of living such as for groceries and transportation.

- NTUC Care Fund (E-Vouchers)

Eligible members would receive up to S$120 worth of assistance on daily essentials and school supplies; with another S$120 for each eligible school-going child and another S$120 for each eligible school-going child studying in a special needs school

In response to CNA TODAY’s queries, various ride-hailing and food-delivery firms stated how they help their platform workers with financial difficulties.

Ride-hailing firm Grab said that in October last year, it rolled out GrabBenefits 2.0, an enhanced suite of benefits for its workers to provide more support for them. These include:

- Subsidies for doctor visits and new access to telemedicine services

- Complimentary preventive healthcare services

- Fuel and vehicle maintenance discounts

- A bursary and scholarship programme for children of eligible driver-partners’ children to receive financial assistance for their education

- Access to GrabAcademy, which has partnerships with various institutes of higher learning and corporate organisations to offer courses and support for its workers who wish to upskill or reskill

TADA said that the firm employs a zero-commission model to “ensure (drivers) take home more of what they earn with every ride” and it has incentive programmes in place to provide them with “an extra financial boost”.

Food delivery company Foodpanda said that it has several initiatives to help its delivery partners, including financial literacy workshops and education bursaries, as well as discounts on petrol, equipment, mobile plans and lifestyle services.

SWITCHING JOBS NOT EASY

For platform workers, the ideal way to overcome income precarity is to go into full-time employment, but that is not always easy.

Mr Norfirdaus, the delivery rider who was diagnosed with cancer, lives with a stoma bag attached to his colon to remove body waste.

He said that he has been looking for alternative employment for some time but has not been able to find something that allows him to manage his condition, since he would frequently have to make trips to the washroom to clear the bag.

His only prior work experience is working as a lifeguard. “With my stoma bag, it’s quite impossible to be a lifeguard again. I won’t be able to go into the water to save people.”

Then there is the flexibility of the job that keeps the gig workers doing this type of work.

Mr Ng the delivery rider said: “The people who do deliveries are usually older, which means some of them are caregivers who need the flexibility and time to care for both their children and their parents, so they cannot do a full-time job.”

MOM's statistics show that about 69 per cent of gig workers who do platform work as their main source of income are aged 50 and above.

The Lendela report also indicated that the share of loan applications from platform workers aged 50 to 69 have gone up steadily from 11.2 per cent in 2022 to 21.1 per cent in 2024.

Furthermore, Assoc Prof Theseira said that work on these platforms suffers from having “low returns to experience and skill”.

“It would not be surprising for a long-term platform worker to have worse prospects than a peer who had been in employment that utilises various skills and training and who has upwards career progression and career accomplishments,” he added.

Mr Peter Yeo, a 52-year-old food delivery rider for seven years, said that it is imperative for platforms to incorporate fairer compensation for its workers, who are increasingly working longer shifts and taking home less income.

“The long hours spent under the scorching sun or heavy rain further worsen working conditions, making it even harder to sustain extended shifts,” he added.

“If this trend continues, many riders may be forced to leave the job altogether.”