IN FOCUS: Is influx of JB property buyers from Singapore, China pricing out locals?

Some Johoreans who have to look for housing options further from Johor Bahru are concerned that homes in the city centre are increasingly reserved for elites and rich foreigners.

Residents walking across the facility floor of R&F Princess Cove. Property prices in Johor Bahru have surged due to interest from Singaporean and Chinese buyers, causing locals to struggle to own their dream homes. (Photo: CNA/Zamzahuri Abas)

This audio is generated by an AI tool.

JOHOR BAHRU: Housewife Nana Razali and her family of six have never had their own home.

The 32-year-old, her husband and their children have been living in a rental flat for the last 13 years in the suburb town of Pasir Gudang, around 20km from Johor Bahru (JB) city centre by road.

Nana has long dreamed of owning a landed property where her children could play in the yard - and of enough space for each child to have their own bed - but the couple’s repeated attempts to apply for mortgage loans for subsale (resale) terrace homes nearer to the city have been rejected due to low household income.

Their applications for new launch apartments under the state’s affordable housing scheme have also been unsuccessful for a variety of reasons, such as loan eligibility and the fact that these units are typically oversubscribed many times over.

“We have to come to terms with the reality that houses in JB are no longer affordable and for now we make do with this fifth floor apartment where the lift is spoiled and the children have barely enough space to do their schoolwork,” said Nana.

She explained that her husband - the sole breadwinner - recently clinched a job in Singapore. He was previously earning a gross income of around RM1,800 (US$400) a month working in a government job in Johor but now gets around triple that amount working at an engineering firm in Singapore.

Even with the increase in household income in recent months, the family have not been able to secure a loan to purchase a home.

“Today, even with a gross housing income of RM5,000 (taking into consideration family expenses), we simply cannot afford a mortgage for any landed property or apartments. The sharp increase of property prices in JB means that we are priced out of our dream home,” she added.

The Johor Bahru residential property market has seen a boom in recent years. Property analysts have attributed this to the influx of foreign buyers post COVID-19, especially from Singapore and China, driving up transaction volume and values in both the new launch and subsale markets.

While the boom has been a plus for property developers and agents in the industry, others are facing a housing crunch.

Local Johoreans like Nana, many of whom have lower purchasing power than foreign buyers, are feeling priced out of the market.

“We are full of regret because a decade ago we were contemplating purchasing a terrace house near the city (in Permas Jaya), and it was priced at around RM80,000. We hesitated and decided to rent, and now the value (of the same house) has shot up to RM260,000,” she said.

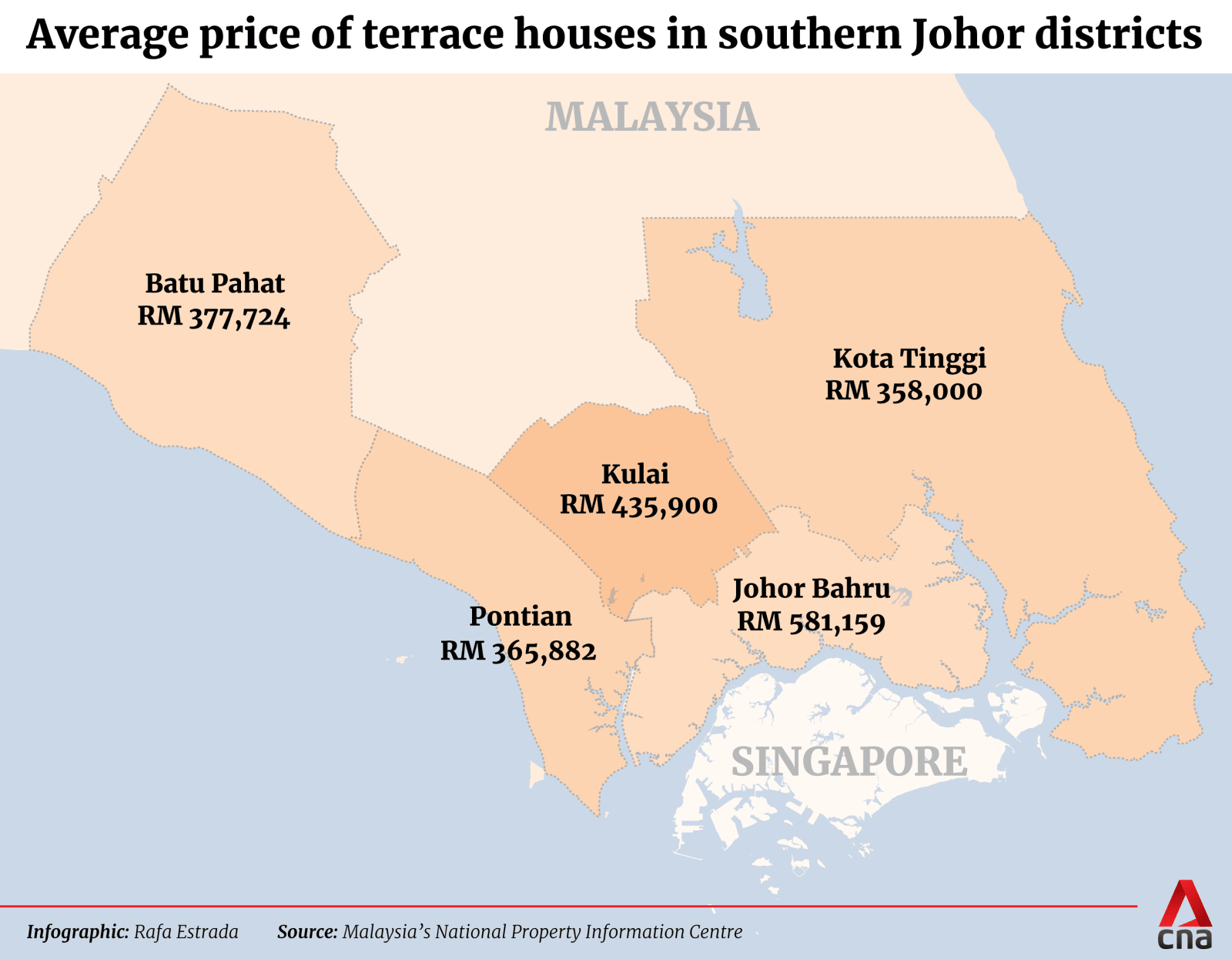

Experts have observed that many locals are forced to rent, downgrade to a smaller home or live further away in suburbs like Kota Tinggi in the northeast and Kulai in the northwest, where the transport infrastructure is less developed, triggering some criticism and frustration.

JB PROPERTY BOOM DRIVEN BY FOREIGN BUYERS

According to a property report released by Knight Frank Malaysia on Jan 13, more than half of the properties in Johor Bahru today are priced at RM800,000 and above. This figure encompasses both new and resale homes.

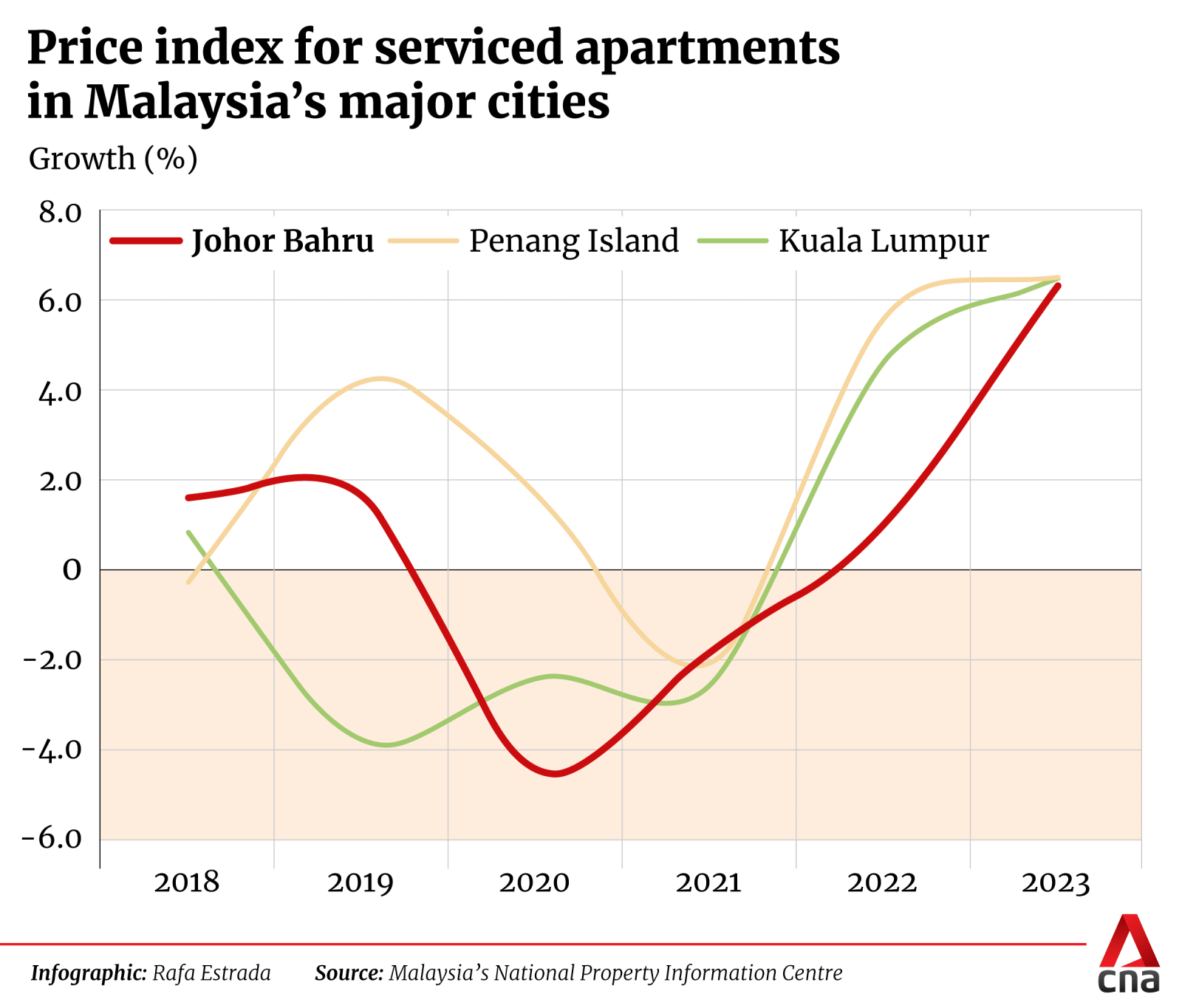

Knight Frank added that for over the first nine months of 2024, the transaction value for condominium units in Johor Bahru had grown by 23.2 per cent and the transaction value of serviced apartments has more than doubled, with a 100.2 per cent increase as compared to the same period in 2023.

Serviced apartments in the Malaysia context refer to upscale condominium units built on land for commercial use. They may be owned by individual buyers for their own stay purposes or to rent out for additional income.

Lee Kun Thye, director of Knight Frank Malaysia’s Johor branch, told CNA that this hike in price and demand is driven by foreign buyers purchasing homes near the Johor Bahru city centre.

She said that the upcoming Johor Bahru-Singapore Rapid Transit System (RTS) Link has been a “crowd puller” for the property market, and apartments within a 5km radius of the upcoming station on the JB side are “selling like hotcakes”.

The 4km JB-Singapore RTS Link is expected to begin service by the end of 2026. It aims to ease traffic congestion on the Causeway – one of the world's busiest border crossings – by ferrying up to 10,000 passengers an hour each way on a journey that takes about five minutes.

“Singaporean buyers have returned to Johor post COVID-19 and definitely these are buyers looking ahead to the RTS improving connectivity with Singapore,” said Lee.

Johor-based analyst Samuel Tan, chief executive of boutique firm Olive Tree Property Consultants, told CNA there has been no official data from government statistics confirming that the property boom is driven by foreigners as the data does not segment the profile of buyers.

However, he said that from conversations with developers and agents, it is clear that the first wave of buyers for recent new launches in Johor Bahru city centre has been dominated by Singaporeans and Chinese nationals.

Tan cited R&F Princess Cove development, a cluster of tall condominiums which overlooks the Causeway and the Johor Strait, as a case in point. The development, built by China-based property developer R&F Group, has launched two phases comprising more than 7,000 units.

It is also within walking distance of the upcoming RTS Link station in Bukit Chagar and the Bangunan Sultan Iskandar immigration complex connected to the Woodlands Causeway.

“When R&F Princess Cove launched its first phase (in 2014) it was selling at around RM700-RM800 per square foot. But today, the better units in phase two and three are selling at more than RM2,000 per sq ft. That showcases the confidence foreign buyers have in the JB property scene,” he added.

Chi Jun En, operations manager at phase two of the Princess Cove development which has around 3,7000 apartment units, told CNA that China nationals and Singaporeans each comprise around 40 per cent of the total residents demographic.

Meanwhile, the remaining 20 per cent is composed of Malaysians, Indian nationals as well as other nationalities like Japanese, South Koreans and Europeans.

“I think Malaysians might not see value in purchasing condominium units at these prices, they would perhaps prefer to stay in landed properties further from town,” said Chi.

Knight Frank Malaysia’s Lee told CNA that projects like R&F Princess Cove and Country Garden Danga Bay appeal to buyers from China because these property firms offer their Johor properties as part of packaged deals when they buy units back home.

“China buyers are playing a different game from the rest in these projects because these companies offer these apartments as part of promotions tied back to their projects back in mainland China.

"So if you buy property in China, you get a discount of X per cent to buy their Malaysia apartments, and these discounts are massive,” added Ms Lee.

LOCALS FORCED TO SETTLE FOR SMALLER HOMES, LIVE FURTHER FROM TOWN

Amid rising property prices in Johor Bahru, industry observers CNA spoke to have noticed that more local Johoreans are being forced to settle for smaller homes than they envisioned and stay in residential areas that are further from the city centre.

Olive Tree’s Tan told CNA that this is “inevitable in any free market” where those with lower purchasing power would be forced to relocate.

“Now (these local Johoreans) can opt for two things, one is to downsize the units and therefore they go for houses which are within the budget. But if you want to maintain size, then they have to opt for places and locations which are further away from the city,” said Tan.

Private sector worker Izzah Masturah Abdul Rashid, who is getting married in the next couple of years, is on the lookout for a matrimonial home. She is eyeing a two-storey landed property near town as both she and her fiance work in Johor Bahru city.

However, she acknowledged that the prices of these homes - which are above RM500,000 - may be out of reach for her and her future spouse.

She said that she may be forced to lower her expectations, and if she insists on living near town, could eventually be forced to rent an apartment in developments concentrated with foreign owners.

This reality is a source of frustration for the 25-year-old.

"We, the Malaysians, are forced to rent from them (foreign owners). This is not an okay situation for me. We are the ones born here, yet they (foreign buyers) are the ones who afford to buy those houses,” said Izzah Masturah.

Even older Johoreans are struggling to find ideal retirement homes.

Hor Lai Huat, 70, who manages a grocery store near a government-funded low-cost housing project in Larkin, is attempting to save up for a more comfortable place in JB to retire.

He currently lives in Skudai, a 40-minute drive from where many of his family and friends live in JB.

However, he admits that finding suitable options at current prices may be a stretch, especially for locals who earn a living in Johor.

“(Housing in JB) is affordable (only) if you are working in Singapore,” Hor told CNA.

Property agent Aqbar Awang of Johor-based firm One Dream told CNA that most of his clients who are locals working in Johor are being forced to shortlist homes in other districts outside of JB such as Kota Tinggi and Kulai.

“These are relatively new townships and there are developers there making new projects. They are a 30-40 minutes drive away, but for many younger Johoreans … this is the reality for many first-time home buyers because of their salary levels,” said Aqbar.

According to statistics released by Malaysia’s National Property Information Centre, the mean price for terrace homes for both new launches and subsale units in Johor Bahru as of the third quarter of 2024 is RM581,159.

This is significantly higher than the RM358,000 and RM435,000 in Kota Tinggi and Kulai respectively.

Tan the property analyst noted that while these areas are more affordable, they are not connected by public transport such as the bus network or the upcoming autonomous rapid transit system, and this would mean they would not be as worthy of investment as homes in town.

“The state can hopefully extend the public transportation network to these districts and this will help people who want to go for more affordable homes,” he added.

STATE GOVERNMENT COMMITTED TO MAKING HOUSING AFFORDABLE

In response to queries from CNA, the office of Johor’s housing and local government executive committee maintained that it is “committed” to ensuring that property is “made affordable to Johoreans” for the long term.

The committee outlined that the Johor state government is “on track to achieving its target of providing 30,000 units of affordable homes by 2026”, an initiative it believes will help alleviate the housing crunch for Johoreans.

It told CNA that the state has also launched the Johor care housing programme which offers homes priced at around RM55,000 through subsidies and other infrastructural assistance.

The Johor state government is cognisant that there is criticism among locals that housing in the city centre is increasingly reserved for elite and rich foreigners.

Those who are frustrated by inflated prices and repeated rejections for homes on the affordability scheme due to applications being oversubscribed have turned to expressing their frustrations on social media pages of the Johor state government.

During a state assembly sitting last November, Johor chief minister Onn Hafiz Ghazi said that the state “accepts all these views with an open heart”.

"The state government acknowledges the importance of housing as an agenda and strives to make the dream of every Johorean to own their own home a reality,” he reportedly said.

The state authorities have also been public in enforcing regulations on developers.

Property developers in Johor are required to allocate 40 per cent of their units to the state’s affordable housing scheme (RMMJ) and price them at around RM300,000 and below.

Last November, the state announced that it had imposed sale restrictions on three developers for failing to adhere to this affordability regulation.

Moreover, it also announced that it has redeveloped RM700 million worth of abandoned housing projects, most of which are located in Johor Bahru and all are reserved for local buyers.

Aqbar the property agent told CNA that these measures indicate that the state is aware of the problem, and determined to alleviate residents’ concerns.

“The redevelopment of abandoned projects - that has been really helpful. Not too long ago they were desolate construction sites, but now they are good developments and very popular. Many of our clients are staying there and the occupancy rates are between 80-100 per cent,” said Aqbar.

“It has been a much-welcomed relief,” he added.

MORE TO PRIORITISE JOHOREANS?

While the Johor state government has put in place regulations to ensure locals are not sidelined when buying property, some question whether these measures are sufficient.

The housewife Nana, who has four children and is expecting a fifth, told CNA that her family has applied five times for a home under the RMMJ affordable housing scheme but they have been turned down each time.

“I’m not sure why our applications were rejected … I think the government can and should do more to ensure no one falls through the cracks,” she posited.

Tan, the property analyst, told CNA that one measure in place is a price threshold for foreigners in the subsale market.

“Currently for Johor, the threshold for foreigners is about RM1 million for most homes and for the landed houses within the international zone this is RM2 million,” he said.

This legislation forces foreigners to buy units in the upper end of the real estate market while leaving the cheaper-priced options for Malaysians.

Given that Johoreans are facing a housing crunch, Tan said the state government should consider increasing the price ceiling for foreigners to buy landed property, and reserve these units for locals as many Malaysians tend to favour terrace, cluster and semi-detached homes.

On the other hand, Tan suggested that the government lower the price threshold for foreigners to purchase condominium and serviced apartment units, as Johor state continues to have an oversupply of these units.

“When it comes to high rises, it's really not a major issue because of the abundant volume of units, especially outside Johor Bahru,” he added.

According to official figures from the third quarter of 2024, Johor has a residential property overhang of 3,030 units. While this was a third less than figures from 2023, the southern state is in third place for most number of overhang units in the country - behind capital Kuala Lumpur and Perak.

Overhang refers to properties that remain unsold nine months after launch.

In addition, during the tabling of the 2025 Malaysia Budget, the federal government announced the Madani Deposit Scheme. The initiative helps first-time home buyers aged between 21 and 40, with the government forking out up to RM30,000 in down payment for homes valued below RM500,000.

Tan suggested that this be extended to home buyers not purchasing for the first time as well to “promote a robust housing market”. The move would also help older Malaysians who are keen to purchase retirement homes, he added.

Knight Frank Malaysia’s Lee added that the state should continue to enforce the 40 per cent quota it has imposed on property developers to develop affordable housing, including on foreign Chinese developers.

“This cap is a good way for the government to ensure that a portion of all developments are within range for local buyers,” she added.

JB’S PROPERTY VALUE STILL APPEALING: SINGAPORE BUYERS

CNA also spoke to Singaporeans who recently purchased property in Johor Bahru, and even though there has been an increase in price since COVID-19, they said buying in JB continues to represent good value for a weekend home or even for rental investments.

Part-time university lecturer Daniel Ong told CNA that he purchased two condominium units at R&F Princess Cove in 2024: A one-bedroom apartment for his retirement pad, and a three-bedroom unit for him to rent out for passive income.

The units cost him around RM640,000 and RM1.3 million respectively.

“So far staying here has triggered good vibes, I get a nice sea view and it's very comfortable,” said Ong, who also owns a private condominium unit on Singapore’s Farrer Road.

“I think there is a possibility we get returns - from both capital appreciation and rental yield - but I’m not too stressed about that,” he added.

However, buying Johor property is not without its challenges for Singaporean buyers.

Some buyers are currently in a legal dispute with a Johor condominium developer over their ownership status, while others are suing Chinese developer Country Garden for fraud and misrepresentation.

Some Singapore investors who bought Johor properties earlier have previously also spoken about their regrets, saying that they did not achieve capital gains for various reasons, such as an oversupply of homes, difficulty in renting out their units and the continuing weakening of the ringgit against the Singapore dollar.

Meanwhile, financial influencer Loo Cheng Chuan, a Singaporean who recently purchased a RM2 million semi-detached home in Mount Austin, has a different take on the issue.

The former chief executive of Singtel Digital Media is of the view that Singaporeans who wish to buy property across the Causeway should be wary of treating the purchase as an investment and that they must be ready to write off capital depreciation from the property value.

“For one simple reason, the powerful Singapore dollar will appreciate against (most) of these currencies and over time you'll find that even if the house value has gone up, the appreciation is somewhat discounted by the Sing dollar strengthening,” said Loo.

On the other hand, he sees value being derived from improving “quality of life”. Living in JB has allowed him to purchase a landed property of a significant size for him, his wife and his three children to enjoy as a weekend home.

The property analyst Tan outlined that the high housing costs in Singapore have become a push factor for some to purchase homes across the Causeway.

“In Singapore, the (monthly) rental for a (two-room) HDB flat could cost (more than) S$1,000 (US$732). This is equivalent to about RM3,500. For RM3,500 they can easily afford (a monthly mortgage) for a landed residential house in Johor and they will have a more leisurely lifestyle, larger space,” said Tan.

Ong added that a key reason why he has chosen to buy property in JB is because of cost of living pressures in Singapore.

He explained that he cannot afford to buy a retirement home given Singapore’s “significantly higher” property prices and he even buys his groceries in JB.

Loo echoed similar sentiments, pointing out that the tide of rising asset prices is a global phenomenon, and that both Singaporeans and Johoreans should do their best to adapt.

“Many Singaporeans are coming (to JB) because property prices have inflated (back home) and they are becoming what I call economic refugees, or abstractly speaking inflation refugees,” said Loo.

“My humble advice to local Johoreans is to adjust yourself to businesses, to jobs that will enable you to rise to the tide as well,” he added.