Johor-Singapore SEZ draws firms seeking space, lower costs amid global uncertainty

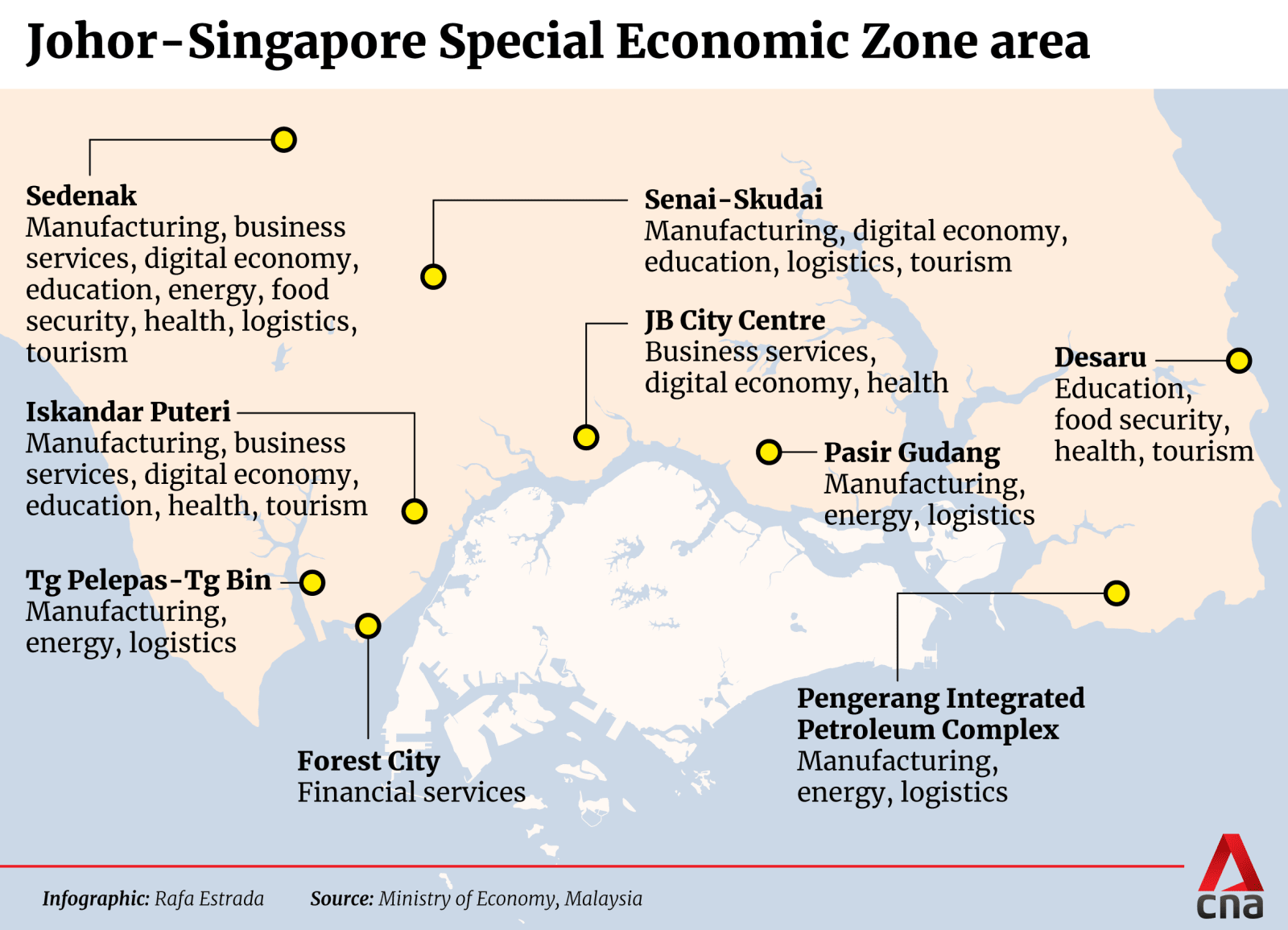

Rising US-China tensions are pushing companies to diversify, with the new economic zone attracting high-tech investments and cost-conscious Singapore firms.

Analysts say the rising interest in the Johor-Singapore Special Economic Zone is driven in part by strong cooperation between Singapore and Malaysia.

This audio is generated by an AI tool.

JOHOR BAHRU: More Singapore companies are setting up operations across the Causeway, drawn by lower costs, space and incentives under the new Johor-Singapore Special Economic Zone (JS-SEZ).

This comes as tensions between the United States and China are pushing firms to rethink supply chains and diversify their operations.

Early investments into the JS-SEZ include data centres and other high-tech industries, while small and medium-sized enterprises (SMEs) are also exploring the Malaysian state as a second home for their Singapore operations.

BROAD MIX OF INDUSTRIES MOVING IN

Emplifi, a co-working hub launched just three months ago, is among the latest developments catering to this demand.

Located in Johor Bahru’s Taman Pelangi district, it offers workspaces at RM330 (US$81) per seat.

About a third of its 66 seats are now occupied by Singapore companies establishing operations across the Causeway.

The 2,300 sq ft facility is run by Singapore-based human resources firm Emplifi, which plans to lease additional office space to add about 130 more seats in the coming months.

The company also supports businesses with sourcing Malaysian talent.

“If they need people, and if we can find the right people, then they come in on a co-working engagement … (a) per head, per desk, per seat kind of arrangement,” said the company’s founder Juliet Tan.

Interest has come from a wide range of sectors, including professional services such as accounting, auditing and marketing, she added.

INCENTIVES, COOPERATION BOOST JB’S APPEAL

Analysts say the rising interest is driven in part by strong cooperation between Singapore and Malaysia.

Under the JS-SEZ, companies can benefit from incentives such as a preferential corporate tax rate of 5 per cent for up to 15 years, alongside efforts to streamline regulations and reduce bureaucracy.

While much attention has been focused on large-scale ventures such as data centres and high-tech sectors like aeronautics, experts say the zone also presents opportunities for SMEs.

Mr Chong Yee Leong, a partner at Allen & Gledhill as well as its associate firm in Malaysia Rahmat Lim & Partners, said space constraints and high land costs in Singapore have long pushed SMEs to look overseas.

Johor Bahru’s proximity allows firms to relocate manufacturing operations while maintaining oversight from Singapore.

“That's one area I think, in the mid to long term, that has a lot of potential to grow,” Mr Chong added.

ROOM FOR GROWTH

Covering more than 3,500 sq km – over four times the size of Singapore – the JS-SEZ offers room for expansion that is increasingly difficult to find in land-scarce Singapore.

Talks are also ongoing to deepen economic integration with Indonesia’s Riau Islands, including Bintan, Batam and Karimun, to further enhance the zone’s attractiveness to investors.

Experts say the longer-term ambition should extend beyond Singapore, Malaysia and Indonesia to include other Southeast Asian countries.

With Southeast Asia projected to become the world’s fourth-largest economy by 2030, they say the JS-SEZ is emerging as an increasingly attractive opportunity for investors.

While China remains a global manufacturing hub, deepening geopolitical tensions with the US are prompting firms to move their factories elsewhere, noted Mr Chong.

He added: “They are looking for alternatives so that they can diversify their risk and ensure that the supply chain is more robust. That's what makes the (SEZ) more attractive than it would have been.”

BEYOND INCENTIVES: WHAT INVESTORS ARE WATCHING

Economists caution that incentives alone will not determine whether the JS-SEZ becomes a lasting second base for Singapore firms.

UOB executive director and head of research Suan Teck Kin said businesses will look closely at factors such as policy continuity, political stability, labour supply and access to resources like electricity and water.

“These are all very important factors when businesses think about investing in a location,” he told CNA’s Singapore Tonight, noting that such decisions involve long-term capital commitments rather than short-term cost-cutting.

Looking ahead, Mr Suan said high-tech industries linked to artificial intelligence and Malaysia’s established electrical and electronics sector are likely to see further growth, alongside data centres.

The country’s role in the “China plus one” strategy – where companies add at least one more country to their manufacturing operations to avoid solely relying on China – places it in a favourable position to support global markets, particularly the US.

Experts add that maintaining business certainty and following through on growth commitments will be key to sustaining investor confidence in the JS-SEZ.