Power tussle at CDL sparks concerns over governance and share price volatility

All eyes are now on whether governance lapses have occurred at the property giant and how swiftly and transparently the company can resolve its internal discord, experts said.

A City Developments Limited (CDL) logo is seen on a building in Singapore on May 26, 2016. (Photo: Reuters/Edgar Su)

This audio is generated by an AI tool.

SINGAPORE: A rare boardroom tussle that has escalated into a legal battle between father and son at City Developments (CDL) has stirred up concerns about the company's governance and future outlook.

All eyes are now on whether governance lapses have occurred at the property giant and how swiftly and transparently the company can resolve its internal discord, industry and corporate governance experts said.

WHAT HAPPENED

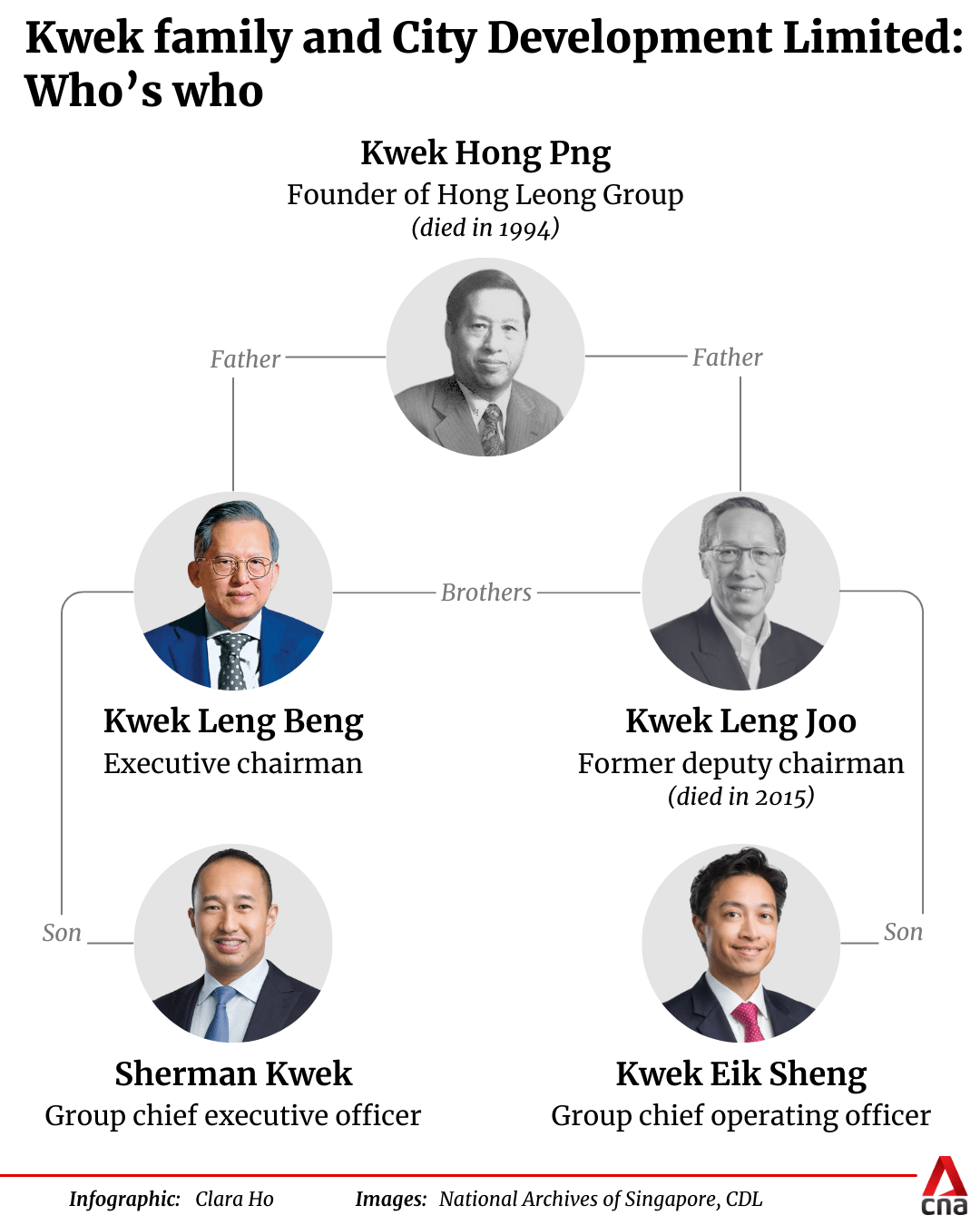

The power struggle within Singapore’s biggest property developer became public on Wednesday (Feb 26) when executive chairman Kwek Leng Beng issued a statement accusing his son, group CEO Sherman Kwek, of attempting a boardroom “coup”.

The senior Kwek alleged that his son and a group of directors bypassed CDL’s nomination committee to push through the appointment of new independent directors, subsequently making significant changes to board committees and governance.

In response, he has filed court papers to “restore corporate integrity” and intends to replace the CEO “at the appropriate time”.

CDL said Mr Sherman Kwek will remain as CEO until a formal board resolution is passed to change the company's leadership.

Trading of CDL shares was temporarily suspended due to the boardroom dispute, though business operations remain unaffected, a company spokesperson added.

In a separate statement, Mr Sherman Kwek described his father’s actions as "extreme" and asserted that the legal action was not authorised by the majority of the board.

He defended the new appointments, saying they were taken “to strengthen CDL’s board” and has “never been about ousting our esteemed chairman”. But the statement stopped short of addressing specific allegations, citing ongoing court proceedings.

Mr Kwek Leng Beng said in a statement late Wednesday night that his son and the other directors acting with him have agreed not to take further action after a court hearing.

The two new directors have undertaken not to exercise any powers as directors until further notice of the court.

Mr Sherman Kwek and the other directors have also undertaken not to take further actions regarding changes to board committees.

APPOINTMENT OF BOARD DIRECTORS

Corporate governance experts said the standard procedure for appointing directors in publicly listed companies requires nomination by the nominating committee, followed by board deliberation and approval at a shareholders’ meeting like an annual general meeting (AGM).

“This structured approach is intended to ensure transparency and compliance with the Singapore Exchange’s Listing Rules and the Singapore Code of Corporate Governance,” said Nanyang Technological University's (NTU) Associate Professor of Accounting Kelvin Law.

Current allegations put forth by Mr Kwek Leng Beng suggested that the circumstances under which the new independent directors were appointed seem to “depart from the norm” in which the nominating committee is involved, said CitadelCorp principal consultant Victor Lai.

“The nomination process takes into account several key steps including searching for the independent candidates, shortlisting and evaluating them, before the nominating committee recommends suitable candidates to the board for approval,” said Mr Lai.

“Subject to the company’s constitution, the board can appoint directors at any time, but the directors who are appointed will have to be re-elected by shareholders at the next AGM.”

But with Mr Sherman Kwek noting that his father's legal actions were undertaken by a minority of the company's board, “this indicates that the current outcomes may have been supported and approved by the majority of the board”, Mr Lai said.

“The key issue to explore moving forward is whether there was indeed a lapse in nominating committee processes that may impact the validity of the appointment of the new directors.”

The senior Kwek also indicated that despite objections to appointing two additional directors, a board meeting was convened on Feb 7 where no vote was taken and a written resolution approving the appointments was passed.

On this, Mr Lai said “there is insufficient information at this point to conclude” whether lapses in board processes have taken place, noting that the relevant governance documents that should be considered include the board charter and the nominating committee charter that set out provisions and requirements specific to CDL.

“For example, the written board resolution referred to above may have been passed by a majority of the board of directors, in accordance with CDL’s constitution and board charter.”

Taking a similar view, Assoc Prof Law said: “If allegations suggest that a nominating committee was bypassed or that appointments were rushed without appropriate vetting nor due diligence, those claims may raise governance concerns.

“However, whether any deviation actually occurred and how significant it might be, depends on facts that have yet to be established or evaluated through proper channels.”

Related:

"TIP OF THE ICEBERG"

Requesting the removal of a CEO based on a governance lapse in the nomination and appointment of board directors is “rare”, said Professor Lawrence Loh from the National University of Singapore (NUS), adding that the latest dispute is “likely the tip of the iceberg”.

Similarly, Mr Lai said: “From my perspective, a governance lapse relating to a (nominating committee) process alone is unlikely to justify and warrant the removal of a CEO.”

Mr Kwek Leng Beng had in his statement cited “a long series of missteps” by his son since he took over the company’s top job in 2018, including the ill-fated investment in Chinese developer Sincere Property Group.

Spearheaded by Mr Sherman Kwek in 2019, the investment was intended to expand CDL's footprint in China. But the onslaught of COVID-19 and regulatory upheaval in the Chinese real estate market ultimately resulted in a S$1.9 billion (US$1.42 billion) loss for CDL in FY2020.

The company later sold its stake in Sincere for US$1 in 2021, but not without causing a rift within the family-controlled business. It led to board resignations, including the departure of non-executive and non-independent director Kwek Leng Peck, a cousin of the senior Kwek.

RHB Singapore analyst Vijay Natarajan described the investment into highly indebted Sincere as a “misstep” taken in an attempt to quickly scale up CDL's presence in China.

“While CDL has operationally recovered from it, we believe the issue still remains as an overhang in the minds of investors who have been looking out for a concrete overseas growth strategy,” he said.

WHAT CAN THE COMPANY DO TO RESTORE CONFIDENCE?

The legal battle is not the first publicised family dispute within CDL, but experts suggest its impact could be more significant this time.

“What can be more serious than a father firing his own son?” asked NUS' Prof Loh.

The legal action taken by the senior Kwek appears to be aimed at issuing a “strong statement that corporate governance is sacrosanct and due diligence is essential”.

“We can take it as the company is moving to upkeep the company in the interest of shareholders. To put it more directly, between company and family ... the company takes precedence over the family,” said Prof Loh, who is director of the Centre for Governance and Sustainability at the NUS Business School.

The elder Kwek's statement noting that CDL is open to appointing a “professional CEO” suggests the company may seek leadership beyond family control to reassure stakeholders, Prof Loh added.

Assoc Prof Law said the removal of a CEO is “generally a major step for any company, particularly one with a family-run background”.

“From an outsider’s perspective, prominent public disputes can create an impression of internal discord, potentially prompting concerns from stakeholders about the company’s strategic direction,” he added.

“Still, the degree of reputational or operational impact hinges largely on how swiftly and transparently the company resolves any internal disagreements.”

If the company’s leadership can demonstrate “clear steps to uphold governance principles and ensure smooth operations”, the long-term effect on brand perception and investor confidence may be mitigated,” said the NTU professor.

On the outlook for the company’s share price, experts generally expect a knee-jerk reaction when trading resumes.

Shares of CDL were last seen at S$5.12.

Over the long term, share price movements will depend on “how convincingly governance issues are resolved and how confident investors feel about the company’s strategic outlook and financial performance”, said Assoc Prof Law.

CitadelCorp's Mr Lai said CDL would likely recover quickly from any knee-jerk reaction in its share price due to the stability of its business operations.

Meanwhile, the Securities Investors Association (Singapore), or SIAS, urged all parties to work towards an amicable resolution in the best interests of CDL stakeholders.

“As the matter is before the courts, SIAS cannot comment on the merits of either party’s position,” said the retail investor advocacy group’s founder-CEO David Gerald.

CDL, founded in 1963 and taken over by the Kwek family in 1972, is one of Singapore’s biggest property firms, with a portfolio spanning residential, commercial and hospitality assets in Singapore. It has been aggressively expanding abroad, with hotels and real estate projects in other countries such as Australia, China and Japan.

Despite its strong market position, its latest earnings report on Wednesday showed a 37 per cent plunge in annual net profit to S$201.3 million, missing analysts’ expectations primarily due to lower contributions from its property development segment.