Down payment losses jump over four-fold to S$1.9 million in 2024 and renovation contractors are a big reason why

Motorcars, electrical and electronics, beauty, renovation contractors and entertainment accounted for the top five highest complaints last year.

Stock image of a frustrated homeowner. (File photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: Consumers suffered about S$1.93 million (US$1.43 million) in prepayment losses last year, the Consumers Association of Singapore (CASE) said on Thursday (Feb 6).

This was more than four times the reported amount stemming from unrefunded deposits in 2023.

The losses were mostly due to sudden business closures, as well as companies becoming unresponsive after customers had put down deposits, said the consumer watchdog in a media release.

About a third of those losses were linked to the renovation industry, after contractors suddenly became uncontactable during the renovation process and leaving behind unfinished homes.

As such, homeowners were left scrambling to find other contractors to complete their renovation works.

Of the 962 complaints CASE received against renovation contractors, about 97 per cent were against non-CaseTrust accredited contractors.

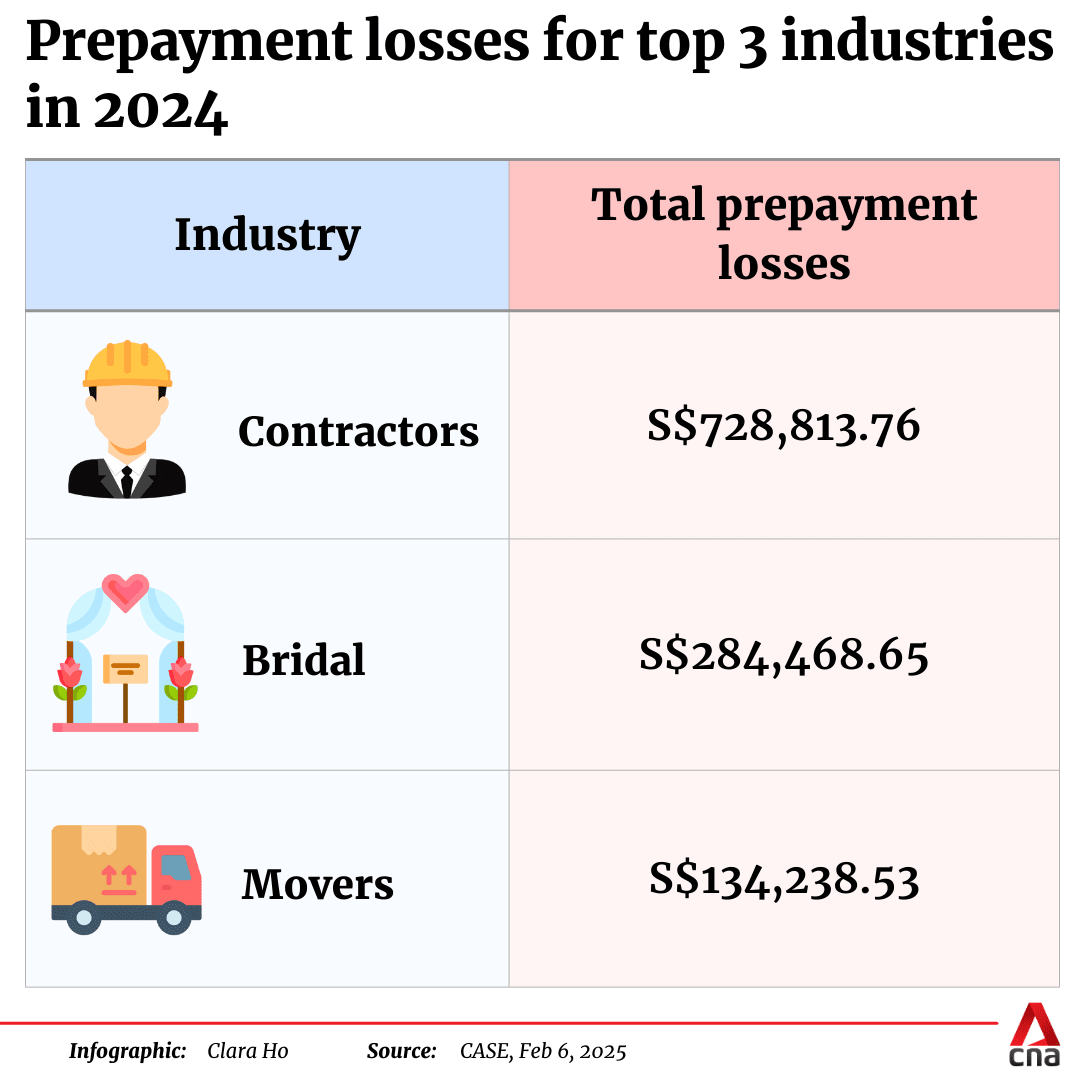

The association noted that while the number of complaints relating to renovation contractors had decreased, the sector accounted for about S$728,000 in prepayment losses - the highest amount in 2024.

Singapore's renovation industry has for years been dogged by complaints about delayed projects, shoddy work and unfinished homes.

"CASE is concerned about the sharp rise in prepayment losses, mainly driven by the renovation sector," said the body's president Mr Melvin Yong.

"All the cases where consumers lost their prepayments and deposits were a result of consumers who had patronised from non-CaseTrust accredited renovation contractors."

In comparison, CASE said that all complaints related to accredited contractors were successfully resolved.

This accreditation by CASE offers protection for consumers, including safeguarding deposits in cases of sudden business closures.

With around S$284,000 and S$$134,000 in prepayment losses, those in the bridal and movers industries made up the second and third-highest offenders in 2024.

This was largely due to the sudden closure of bridal shop Love Nest, which was located at City Gate mall along Beach Road, and its related entities in April, as well as the loss of goods during moving and large deliveries not being fulfilled, according to CASE.

In January, CNA reported that Singapore-based relocation firm Moovaz is under police investigation after customers faced months of delays in receiving their belongings despite paying thousands of dollars for the company's services.

CASE told CNA it received 22 complaints against Moovaz from Jan 1, 2024, to Jan 22 this year, with losses amounting to about S$80,000.

"Consumers are advised to engage CaseTrust accredited companies whenever the purchase involves large prepayments because these companies buy insurance to protect your interest," said Mr Yong.

He added that more safeguards are needed for consumers in sectors that collect large prepayments.

Related:

BREAKDOWN OF COMPLAINTS

Customers lodged 14,236 complaints in 2024, a 2 per cent increase from the 13,991 complaints CASE received in 2023.

Motorcars, electrical and electronics, beauty, renovation contractors and entertainment accounted for the top five highest complaints.

The entertainment industry saw the largest spike in complaints from 209 cases in 2023 to 798 in 2024. The 281 per cent jump in complaints were mostly due to the "botched" Singapore Sky Lantern Festival in February last year and complaints arising from ticket scalping.

F&B as well as telecommunications were two other sectors that had a big rise in complaints.

F&B complaints increased by 24 per cent from 571 cases in 2023 to 708 in 2024, mainly due to the cancellation of Sakura Buffet's licence over food safety concerns, which left customers' orders unfulfilled.

Complaints pertaining to the telecommunications industry rose by 34 per cent from 529 cases in 2023 to 710 in 2024, as consumers typically complained of poor connectivity, delayed installation of broadband services and high bill charges.

Of the cases that CASE was authorised by consumers to negotiate with businesses in 2024, about 80 per cent were resolved. The body added that this is a 4 per cent improvement from 2023 and is its highest resolution rate in the past five years.

In a first, two nail salons under the Nail Palace chain and its managing director Kaiden Cheng were also fined and jailed respectively last year after being found guilty of contempt of court.

They had failed to comply with court orders in relation to unfair trade practices over the sale of anti-fungal treatment packages. CASE had referred Nail Palace to the Competition and Consumer Commission of Singapore (CCCS) for investigation, following multiple complaints about "pressure sales tactics and misleading sales".

MOTORCARS, E-COMMERCE INDUSTRIES

The motorcar industry saw the most complaints in 2024 with 1,306 cases - the same as in 2023. Of the complaints, around 35 per cent were related to car sharing and leasing, an increase from 33 per cent in 2023.

On the sector, Mr Yong said: "CASE has formed a working committee to address the issues relating to car sharing and we are making good progress in our discussions with the relevant stakeholders.

"In the meantime, consumers are advised to read carefully the terms and conditions when engaging in car-sharing services. Consumers can also check online for reviews by other users."

For e-commerce, CASE received 4,641 complaints in 2024, a 25 per cent rise from 3,711 cases in 2023. This is the highest number of e-commerce complaints tracking began in 2020.

Of those complaints, about 13 per cent were from the entertainment sector and 9 per cent were from F&B.

Mr Yong noted that not only did e-commerce complaints increase but they reached an all-time high in 2024.

However, he added that this was a reflection of the growing shift towards e-commerce as a preferred mode of shopping.

"CASE has worked with the two biggest e-commerce platforms in Singapore, Shopee and Lazada, to put in place an effective dispute resolution framework," said Mr Yong.

Complaints involving these platforms have a "high resolution rate" of about 90 per cent, he added.

"CASE will continue working with other platforms to provide consumers with better protection when shopping online."