At least S$1.1 billion lost to scams in 2024; one victim had S$125 million stolen

Four scam cases alone accounted for S$237.9 million in losses.

E-commerce scams made up the highest number of reported cases among all scam types in 2024, with concert tickets the top item involved in the scams. (File photo: iStock/ArisSu)

This audio is generated by an AI tool.

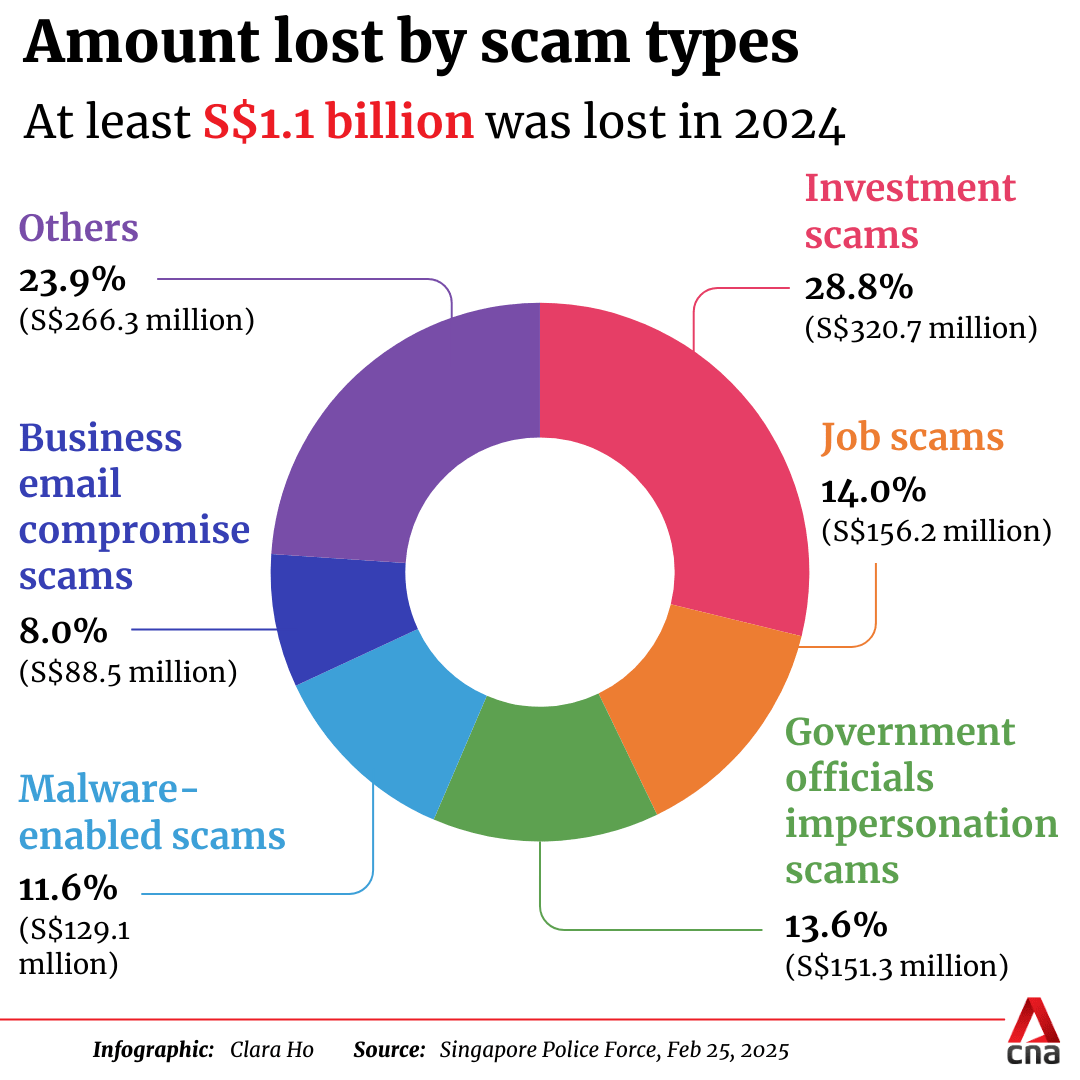

SINGAPORE: At least S$1.1 billion (US$822 million) was lost to scams in 2024, with one victim losing S$125 million in cryptocurrency, the Singapore Police Force (SPF) said on Tuesday (Feb 25).

The total amount lost to fraudsters rose by 70.6 per cent from at least S$651.8 million in 2023, according to the police's annual statistics on scams and cybercrime.

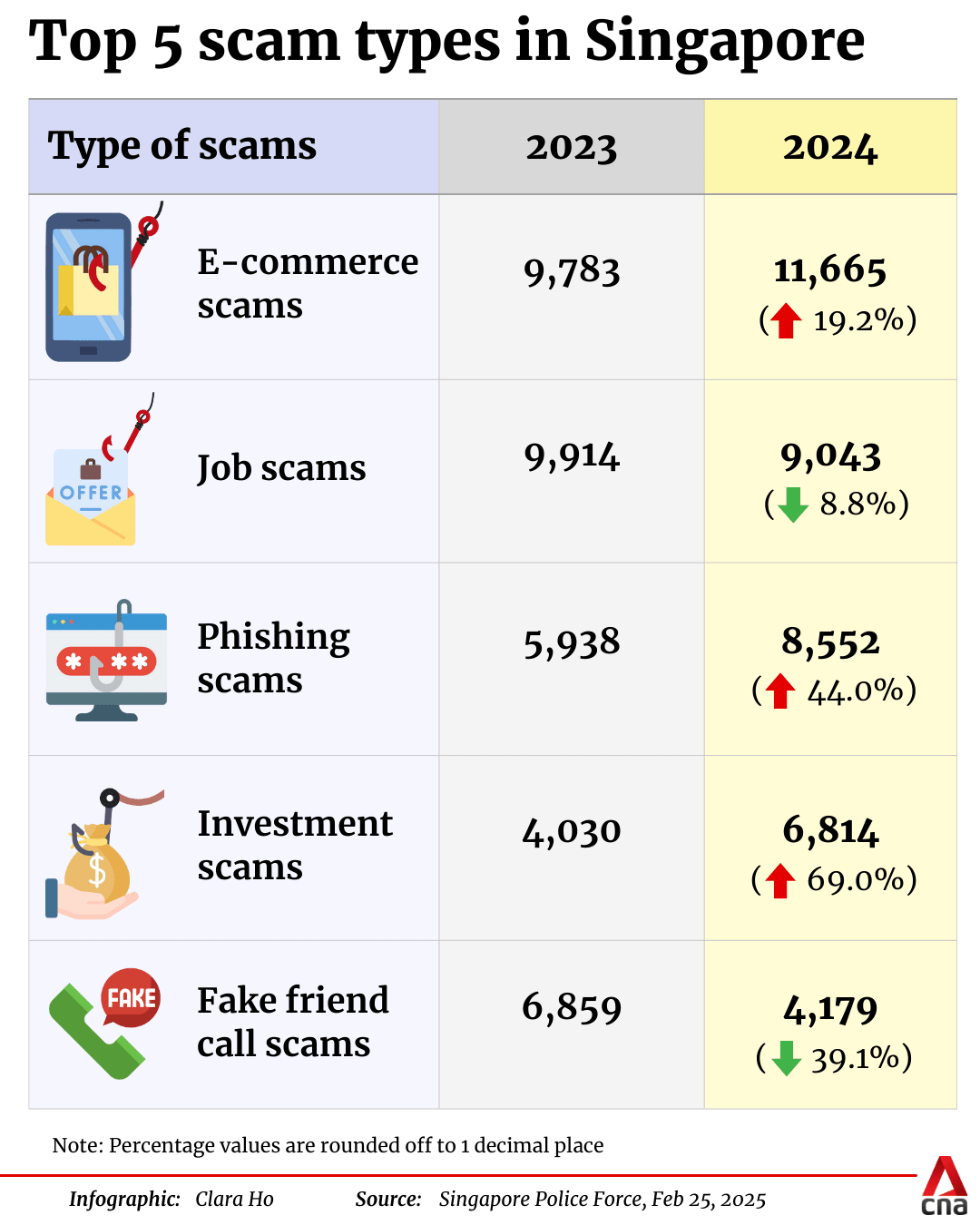

The total number of scam cases also increased by 10.6 per cent to 51,501 cases in 2024 from 46,563 in 2023.

Cryptocurrency losses made up a larger percentage of scam losses last year, accounting for about 24.3 per cent of total scam losses, compared with about 6.8 per cent in 2023.

E-commerce scams were the top scam type flagged by the police, followed by job scams, phishing scams, investment scams and fake friend call scams.

While there were increases in e-commerce, phishing, investment and government officials impersonation scams, there were "significant decreases" noted for those involving fake friend calls - both in the number of cases reported and the total amount lost.

SPF attributed this to its collaboration with the Royal Malaysia Police to dismantle three fake friend call scam syndicates operating from Johor Bahru, leading to the arrest of 19 overseas syndicate members.

There were also "notable" decreases in the number of malware-enabled scams and social media impersonation scams, largely due to the measures implemented by the government as well as banks and telecommunications companies.

However, there were increases in the total amount lost to these two scam types due to two cases with "very high" losses, said SPF.

A single malware-enabled scam case saw the loss of about S$125 million in cryptocurrency.

The victim had clicked on fake interview meeting links and was asked to run a script on his laptop. The script was actually a malicious code that targeted crypto wallets.

Self-effected transfers - where individuals willingly transfer money to scammers - accounted for 82.4 per cent of total reported scam cases last year.

In most of these cases, the scammers did not gain direct control of the victims' accounts, but manipulated them into performing the monetary transactions.

Some individuals were so taken in by the scammers' deceit that they refused to believe that they were being scammed despite repeated advice from loved ones, their bank, and even the police, SPF said.

SPF noted that its Anti-Scam Command - which was set up in March 2022 - managed to recover more than S$182 million of scam losses in 2024, making the net loss about S$930 million.

Through "proactive interventions" with victims at various stages of being scammed, the Anti-Scam Command unit and its partners also averted at least S$483 million in potential losses, SPF added.

SMALL NUMBER OF CASES WITH "VERY HIGH" LOSSES

More than 70 per cent of the scam cases last year led to losses of less than S$5,000, the police said, adding that the median loss per case fell by 12.6 per cent from S$1,590 in 2023 to S$1,389 in 2024.

However, there was an overall increase in the total amount lost - driven by a small number of cases with "very high" losses.

Scam cases with losses of at least S$100,000 made up 3.3 per cent of the scam cases last year but accounted for 70.8 per cent of the scam losses.

Four cases, in particular, accounted for S$237.9 million.

The police estimated that the amount lost in these four instances accounted for 21.4 per cent of the total scam losses in 2024.

Millions lost in four scam cases

1. Malware-enabled scam

While the number of malware-enabled scam cases dropped by 84.8 per cent to 289 cases in 2024, the total amount lost to this scam type jumped by 278.6 per cent to S$129.1 million. This was largely attributed to a single case that amounted to about S$125 million in losses in cryptocurrency, said SPF.

In this case, the victim discovered unauthorised cryptocurrency transactions after clicking on fake interview meeting links and was asked to run a script on his laptop. The script was a malicious code that targeted cryptocurrency wallets.

2. Business email compromise scam

The total amount lost to this scam type increased by 107.8 per cent to S$88.5 million despite a slight decrease in the number of cases.

This spike was largely attributed to a single case involving a Singapore commodities firm that fell prey to the scam variant involving business dealings. The company ended up paying S$57.2 million to a fraudulent bank account in Timor-Leste in July last year.

The affected company had received an email purportedly from a known vendor about a change in bank account details for payment.

The company subsequently made payment to the "updated" bank account but later realised that they had been scammed after receiving a late payment notice from the actual vendor.

3. Phishing scam

A single phishing scam case saw a loss of about S$33.8 million in cryptocurrency. The victim had chanced upon a phishing advertisement offering lucrative rewards while browsing on a legitimate cryptocurrency wallet application.

The victim was redirected to a third-party site resembling the company behind the legitimate crypto wallet application, scanned a QR code and provided crypto wallet login credentials. The victim subsequently discovered unauthorised cryptocurrency transactions.

4. Social media impersonation scam

Though this scam type decreased by 53.6 per cent to 728 cases last year, the total amount lost increased by 172 per cent to about S$26.4 million.

In one case, the victim made cryptocurrency transfers under the impression that he was communicating on Telegram with a known contact who was a company director. The victim ended up losing S$21.7 million in cryptocurrency.

CONCERT TICKETS TOP ITEM IN E-COMMERCE SCAMS

E-commerce scams recorded the highest number of reported cases among all scam types in 2024, with 11,665 cases reported and at least S$17.5 million lost.

Concert tickets were the top item involved, with related cases accounting for 22.4 per cent of the total e-commerce scam cases in 2024, as compared with 11.7 per cent in 2023.

Victims typically came across concert ticket listings online and were asked to transfer payments. In some cases, victims received the tickets, but only realised that they were fake when they were unable to use them to enter the concert venue, the police said.

The police added that concert ticket scams pivoted to take place on messaging platforms such as Telegram, where interventions and disruption efforts are "harder" compared with traditional e-commerce marketplaces.

More than 330 people fell victim to scams involving the sale of pop star Taylor Swift's concert tickets in January and February last year, with total losses amounting to at least S$213,000.

Swift held her Eras Tour in Singapore over six nights at the National Stadium in March.

The majority of e-commerce scam victims were aged 30 to 49, accounting for 45.1 per cent of victims for this scam type.

The most common platforms on which e-commerce scams were conducted included Facebook, Carousell and Telegram.

While e-commerce scams had the highest number of reported cases, other scam types - namely phishing, investment and government officials impersonation - saw "sharp increases" in both the number of cases reported and the amount lost.

In particular, investment scams were the fourth highest number of reported cases among all scam types in 2024, with 6,814 cases.

However, the total amount lost to such scams was the highest among the various types - at least S$320.7 million.

There was also an increased prevalence of scammers adding victims to chat groups or channels on messaging platforms such as WhatsApp and Telegram for purported "investment opportunities".

The majority of investment scam victims were also aged 30 to 49, making up 44.2 per cent of victims for this scam type.

Telegram, Facebook and WhatsApp were the most common platforms used by these scammers to contact potential victims.

META PRODUCTS, TELEGRAM "PARTICULARLY CONCERNING"

Scammers commonly reach out to victims through messaging platforms, social media, phone calls and online shopping platforms, SPF found, with messaging platforms being the most common method.

Scammers contacted victims via messaging platforms in 15,145 cases last year - up from 12,368 in 2023.

WhatsApp and Telegram were the top two messaging platforms exploited by scammers, the police said.

The number of scam cases perpetrated on Telegram also saw an increase of about 95.7 per cent.

The number of cases where scammers contacted victims via social media increased to 14,991 in 2024 from 13,725 in 2023. In particular, 59.8 per cent were contacted through Facebook, 18 per cent through Instagram and 13.2 per cent via TikTok.

The police also pointed out that online shopping platforms were a "contact method of concern". The number of scam cases that took place via these platforms increased to 5,079 in 2024, up from 4,893 in 2023.

Of these, 75 per cent occurred on Carousell and 18.3 per cent on Facebook Marketplace.

"Three products from Meta (Facebook, WhatsApp, Instagram) and Telegram remain particularly concerning, consistently being overrepresented among the platforms exploited by scammers to contact potential victims and conduct their scams," said SPF.

SCAM VICTIMS

Similar to previous years, younger people were found to have fallen prey to scams more than older individuals. Those aged below 50 made up 70.9 per cent of scam victims in 2024.

On the other hand, while the elderly made up only a small proportion of scam victims, the average amount they lost per victim was the highest among the various age groups.

Youths aged 19 or below made up 6.3 per cent of scam victims, while young adults aged 20 to 29 accounted for 23.4 per cent. Adults aged 30 to 49 made up 41.2 per cent.

All three age groups tended to fall for e-commerce, job or phishing scams.

"Young seniors", such as those aged 50 to 64, formed 20.7 per cent of scam victims. This group mostly fell for phishing, investment and fake friend call scams.

This was also the case for those aged 65 and above, making up 8.4 per cent.

FIGHTING SCAMS, CYBERCRIME

Scams and cybercrime remain a "pressing concern" said the police, adding that the total number of scam and cybercrime cases increased by 10.8 per cent to 55,810 cases in 2024, compared with 50,376 cases in 2023.

The police highlighted various measures and legislations in place to fight these crimes, including the Protection from Scams Act that was passed in parliament earlier this year.

The new law provides the police with powers to issue a restriction order to banks to restrict the banking transactions of an individual if there is reason to believe that the person is likely to make money transfers to a scammer.

This will give the police more time to engage and convince the person that he or she is being scammed, SPF said.

The Anti-Scam Command also seized more than 31,000 SIM cards and arrested 13 people during enforcement operations to address the misuse of SIM cards in scam activities.

Under a new law which came into effect on Jan 1, authorities can target three groups of people who misuse local SIM cards to facilitate scams - irresponsible SIM card subscribers, middlemen involved in procuring or providing local SIM cards to scam syndicates as well as errant retailers.

Last year, SPF also disrupted more than 57,700 mobile lines, more than 40,500 WhatsApp lines, over 33,600 online monikers and advertisements, and over 44,900 websites that were scam-related.

"This is a significant increase in disruptions as compared to 2023, and was done through collaborations with major industry stakeholders such as Meta, Carousell, Google and the telecommunications companies," said SPF.

Noting the increase in scam numbers and total amount lost last year, Deputy director of the Scam Public Education Office Jeffery Chin said: "Scammers will constantly find ways to scam us into making fast decisions."

"We would like to urge everyone to slow down, take a moment to check if you are unsure if something is a scam," Mr Chin said, pointing to resources such as the ScamShield Helpline 1799 and the ScamShield app.