CNA Explains: Trump's tariffs and what they mean for Asia

What's “reciprocal" about the US tariffs, why is Donald Trump doing this and what's been the reaction from this part of the world?

US President Donald Trump speaks during a "Make America Wealthy Again" trade announcement event in the Rose Garden at the White House on Apr 2, 2025 in Washington, DC. (Photo: Chip Somodevilla/Getty Images via AFP)

This audio is generated by an AI tool.

SINGAPORE: United States President Donald Trump called Wednesday (Apr 2) “one of the most important days, in my opinion, in American history” as he unveiled a raft of tariffs for the rest of the world.

It's part of the president's plan to address trade imbalances, and will lead to Asian economies contending with sharply higher tariffs.

What are “reciprocal" tariffs?

First, tariffs are taxes placed on foreign-made imports.

With reciprocal tariffs, the US aims to mirror import duties placed by other economies on American-made goods.

The world’s largest economy generally has lower tariffs than those it trades with.

Under Trump, the White House has criticised this lack of reciprocity.

For example, it cited a 2.7 per cent tariff on unhusked rice versus 80 per cent by India, 40 per cent by Malaysia and 31 per cent by Turkey on the same.

But it's not as simple as matching numbers.

The Trump administration has said that in determining “the equivalent of a reciprocal tariff” with each trading partner, it looked not just at import duties but also other practices it considers unfair.

Some of these include value-added tax, government subsidies, currency manipulation tactics, technology transfer practices and lack of intellectual property protection.

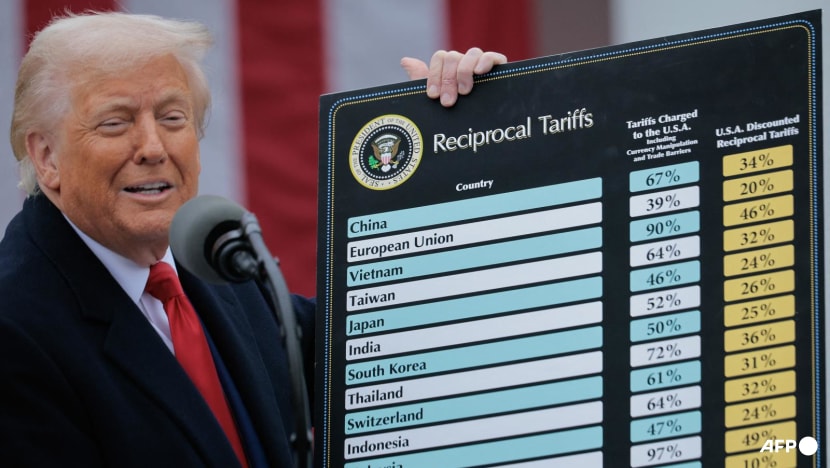

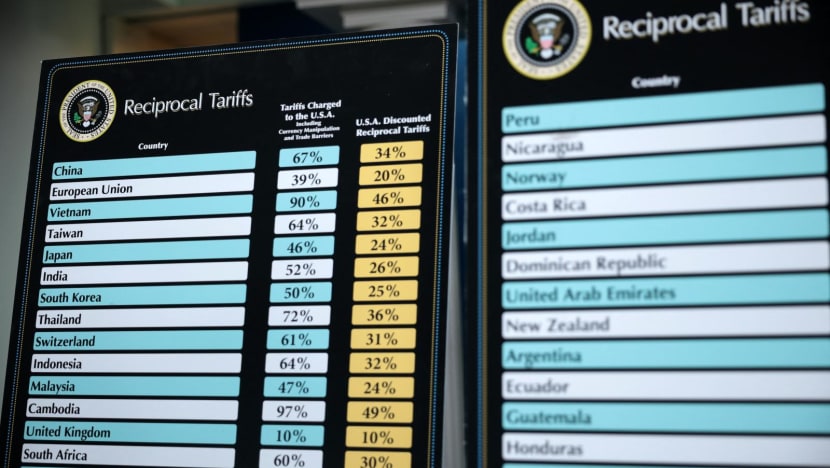

What are the new tariffs for Asia?

The US is imposing a universal 10 per cent tariff on all imports.

This will take effect on Saturday (Apr 5) at 12.01am, Eastern Standard Time (12.01pm, Singapore time).

From next Wednesday (Apr 9), the US will also impose a higher reciprocal tariff on close to 60 economies with which it has the largest trade deficits.

In Asia, these include:

- Cambodia – 49 per cent

- Laos – 48 per cent

- Vietnam – 46 per cent

- Myanmar – 45 per cent

- Thailand – 37 per cent

- China – 34 per cent

- Indonesia – 32 per cent

- Taiwan – 32 per cent

- India – 27 per cent

- South Korea – 26 per cent

- Brunei – 24 per cent

- Japan – 24 per cent

- Malaysia – 24 per cent

- Philippines – 18 per cent

These rates include the 10 per cent baseline.

Singapore – the only country in ASEAN with which the US has a trade surplus – faces the baseline 10 per cent tariff.

China’s total tariff rate, meanwhile, will amount to 54 per cent as its reciprocal levy comes on top of an existing 20 per cent imposed earlier this year.

Trump did not provide jurisdiction-specific reasons for the individualised tariff rates.

But on Monday, the US Trade Representative (USTR) released an annual report assessing trade barriers with other economies. This provides some indication.

For example, in Vietnam’s case, the USTR took issue with the country’s import bans on certain goods; regulations for pharmaceuticals, medical devices and information technology products; food safety laws; and failure to deter counterfeiting and piracy, among others.

How is the reciprocal tariff actually calculated?

The USTR has published online its method.

Essentially, it takes the goods trade deficit the US runs with a partner, and divides it by the total goods the partner exports to the US.

It appears this figure is then divided by two to produce what the Trump called “discounted” reciprocal tariffs.

He referred to them as such because they are still lower than what the US calculates each trading partner has levied on American goods, when currency manipulation and trade barriers are factored in.

Let’s take Cambodia as an example.

The US trade deficit with Cambodia in 2024 (US$12.34 billion) divided by the goods Cambodia exported to the US in the same year (US$12.66 billion) gives about 0.97.

According to Trump, Cambodia charges the US a 97 per cent tariff.

This appears to have then been halved and rounded to give the reciprocal tariff of 49 per cent levied on Cambodia.

Why exactly is Trump doing this?

Retaliatory tariffs are a common tactic in bilateral trade disputes. But the sweeping nature of this set of tariffs – which will hit all jurisdictions – has been described as unprecedented.

Trump has prioritised reducing the US’ trade deficit, which is when a country’s imports exceed their exports, as a solution to economic woes.

Last year, the US hit a record goods trade deficit of US$1.21 trillion. Its total annual trade deficit across goods and services was US$918.4 billion.

The US’ largest goods trade deficits were with China (US$295.4 billion), the European Union (US$235.6 billion), Mexico (US$171.8 billion), Vietnam (US$123.5 billion) and Ireland (US$86.7 billion).

All of this has been a thorn in Trump’s side. His executive order on Wednesday repeatedly referred to “large and persistent” annual goods trade deficits and the “structural asymmetries” that drive them.

He also blames trade imbalances for the decline of US manufacturing capacity and jobs; and for making its defence-industrial sector dependent on “foreign adversaries”.

“It’s our declaration of economic independence,” Trump said on the White House lawn.

“For years, hardworking American citizens were forced to sit on the sidelines as other nations got rich and powerful, much of it at our expense. But now, it’s our turn to prosper.”

How has Asia reacted?

Leading up to what's been dubbed “liberation day” on Wednesday, governments were already rushing to lobby the US and negotiate deals in attempts to avoid higher tariffs.

In the immediate aftermath:

- China’s commerce ministry vowed countermeasures if the US did not immediately cancel its latest tariffs

- India’s commerce ministry said it was analysing the impact, with local media reporting an official calling it “a mixed bag and not a setback”

- Japan’s trade minister demanded an exemption and expressed “serious concerns” about whether the tariffs were consistent with World Trade Organization rules

- Singapore's deputy prime minister, who's also trade and industry minister, said the country was disappointed but would not take retaliatory measures, and would instead engage the US to understand its concerns

- South Korea’s acting president ordered emergency support measures for affected businesses, including automobiles, and asked the industry minister to negotiate with the US to minimise the impact

- Taiwan's government called the new tariffs "unreasonable" and said it would discuss them with the US

- Thailand's prime minister said the country has a "strong plan" in place and hopes to negotiate a tariff reduction

- Vietnam's prime minister called for a "rapid response team" and is sending the country's deputy prime minister on a working visit to the US

What will be the impact?

Since Trump first announced his trade plan in February, economists have said that higher tariffs could raise consumer prices and slow economic growth in the US.

These warnings continued after Wednesday’s announcement.

OCBC managing director for investment strategy Vasu Menon said the tariffs were likely to cause the US economy to slow down more than expected, and inflation to stall or rise.

But the US may not slip into a recession if Trump shows openness to negotiations, he added.

"Some comfort can be found from the fact that the White House is fully aware that an aggressive tariff agenda that hurts US growth badly, could also hurt the Republican party’s chances in the mid-term elections," said Mr Menon. "This may see Trump dialling back on some tariffs in time."

The tariffs also raise concerns about inflation, said JP Morgan Asset Management’s chief market strategist for Asia-Pacific Tai Hui.

Inflation could be impacted as the US struggles to increase manufacturing capacity and supply chains pass on costs to consumers, he said.

“US consumers may cut back on spending due to pricier imports, and businesses might delay capital expenditures amid uncertainty about the tariffs’ full impact and potential retaliation from trade partners,” he added.

DBS Group’s senior foreign exchange strategist Philip Wee said in a note that the reciprocal tariffs on emerging Asian economies were “notably high”.

This sends a message that the US is not just targeting China directly, “but also indirectly blocking the ‘China Plus One’ strategy many companies use to diversify supply chains to circumvent US tariffs”.

This is not the end of the road, and there's still room for “negotiation, retaliation and further potential escalation”, said OCBC chief economist Selina Ling and ASEAN economists Lavanya Venkateswaran, Ahmad A Enver and Jonathan Ng.

In Southeast Asia, they expect Vietnam's growth to be the hardest hit by tariffs, followed by Thailand and Malaysia, with Indonesia and India more insulated.

In an earlier note in March, DBS Group senior economists Chua Han Teng and Radhika Rao said that aside from the direct hit from higher tariffs, a second-order impact on Southeast Asian countries could also come from slower growth in the region’s key trading partners – China, and the US themselves.